“Stock trading is an activity where people with money meet people with experience. After spending the day together, they exchange assets and go home”….Unknown

“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful”…Warren Buffet

Where are we, at the end of April 2020?

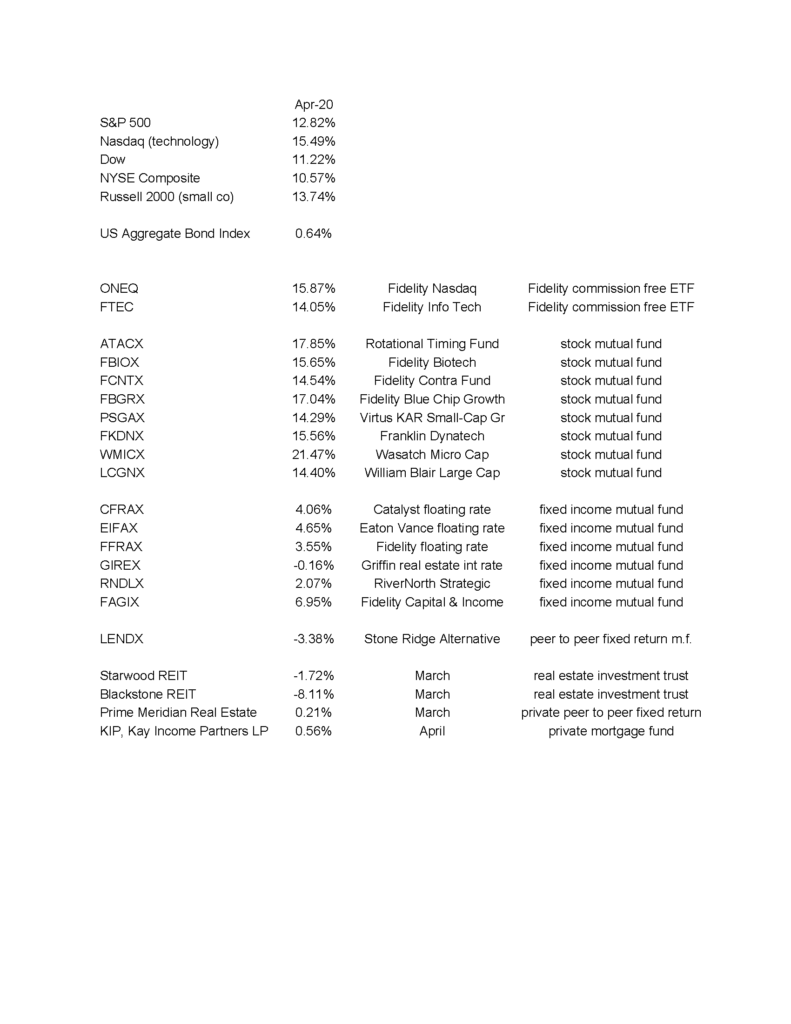

The stock market has regained nearly all of its losses due to the horrific month-long period of late February to late March. In fact, our technology-oriented holdings (ONEQ, FTEC and FKDNX) now carry a profit YTD (year-to-date). However, there is still damage to our REIT holdings, floating rate funds and small company stock funds.

The big question is how, if and when the economy returns to its healthy, pre-lockdown state. There is also the question of whether the stock market is truly in total recovery or if we may re-test the March lows. My concern is that the huge increase in government debt will eventually demand a reckoning since free money cannot really be free. I am confident of this but the timing is unknowable.

I’ve certainly learned a valuable lesson myself (among other things): that stock market history doesn’t reliably repeat. Bear markets historically give warnings over periods of months while in this case all-time highs in mid-February gave way to a horrendous crash in March. My goal is to use more and better tools to prepare for the future. I am testing artificial intelligence software toward this end – more on this in future weeks.

Perhaps the biggest challenge remaining is to find the elusive fixed income fund, particularly for those of you drawing steady income to live on. The REITS that served us so well over the last year-plus, lost money in April – most particularly Blackstone. There just seems to have been no safe place other than long term US Government bonds, which generate virtually no income and fluctuate greatly in their market values. Regardless, the REIT monthly income stays steady even while unit/share values slipped some.

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.

How Did the Markets and our Funds Do in April 2020?

The below numbers are courtesy Morningstar Workstation: