For the last few years we’ve lived in a world of low market volatility and steady gains. Since the fall of 2011 the markets have had no precipitous drops. The reason for this, of course, has been the unprecedented Federal Reserve actions to suppress interest rates and make easy money available. The stock market has loved it. However, if you’re a retiree bagging groceries at Walmart because you can’t live on 0.27% interest on your savings, you hate it. Can anyone remember when a CD paid 7%?

Unfortunately (from the stock market’s perspective), endlessly steady gains can’t continue forever. Disruptions and excesses (related and unrelated) just can’t be stopped. Crashing oil prices are a disruption. It’s great for us consumers, for airlines and most other users of fuel. But it is a disruption for energy companies, countries that sell oil and countless workers in that industry. The dollar is surging, which is great if you’re shopping for items produced abroad but it’s putting a squeeze on US corporations that sell abroad, where dollar denominated goods are getting very expensive. Proctor and Gamble failed to meet its profit targets for this very reason.

There are internal signs that the current bull market, that started in 2009, is aging and may be ready for a cyclical fall. This should not come as a great surprise – we would just like to minimize our losses and get ready to make money afterward. The signs include decreasing numbers of companies making new highs in their prices and a weakening in the smaller to mid size stocks. Since early last year, money has been flowing from smaller into larger companies as institutions move to safer ground.

Interestingly, despite the apparent strength in larger company stocks in 2014 (for example the Dow, Nasdaq and S&P 500), the average stock actually did not fare so well. The New York Stock Exchange Composite index rose just 4.22% last year. Since October, we’ve seen strong ups and downs, back and forth within a fairly narrow range, waiting for a sign that we will either break up or down.

The funds that we’ve used to hedge and protect our portfolios have not performed especially well during the last couple of years. They have under-achieved versus their historical expectations. The reason for that is we have not lived in normal times. There is evidence that this is about to change. These “alternative” funds use volatility to make money, thus adding protection in periods that are more volatile (and threatening to principal).

2015 thus far has been twice as volatile as was all of 2014. The markets have alternated between strong and weak, ultimately losing approximately 3% for the month of January. On Monday and Tuesday, the first two days of February, it has gained most of that back, leaving a small loss for the year. Meanwhile, two of our alternative funds, AMFQX and HFXAX, made over 3% and over 4% respectively for the month. Higher market volatility has awakened them and they’re doing their job. Our average account lost less than one percent or made a small gain for the month.

I welcome a return to more normal times. A distorted market environment isn’t truly healthy.

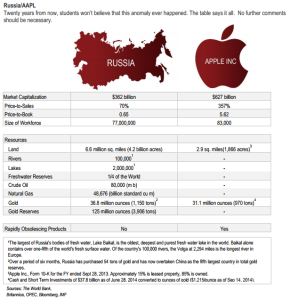

I saw an amusing graphic regarding Apple stock (courtesy 361 Capital Weekly Research Briefing). Apple has become so big it’s almost like an index unto itself. Practically every mutual fund owns it. It even compares to a country (click the graphic with your mouse to make it larger):

Please contact me if you would like to discuss your risk profile.

We have moved. Please note our new address and contact information below. We’re now situated a little more equally between the two coasts and the clients.

Darrell J Kay

Kay Investments Inc

11 E Alary Ln

Corrales NM 87048

(505) 800-5939