“You can observe a lot by just watching” …. Yogi Berra

“If you can’t explain it simply, you don’t understand it well enough” … Albert Einstein

Where are we, at the end of August 2020?

Here are the simple facts:

- August was a strong month for stocks – again.

- We are due for a correction and the September/October period is a common timeframe for that.

- We have a stock market that is increasingly dominated by COVID winners, especially technology companies.

Interestingly, while the NASDAQ (technology index) is up 32% YTD as of 8/31, the NYSE composite and the Russell 2000 small company indexes are down approximately 5%. This is a gross imbalance. We have long been heavily weighted toward technology, except for the ATAC fund, which is up an unreal 63.08% YTD as of yesterday. Unfortunately, ATAC provided zero gain for August – an indication that the manager is not always perfect. Therefore, if you hold more or less of this fund, your account rose less or more.

If you are drawing a monthly income in retirement, I am building a portfolio of dividend paying stocks – yielding around 8% – with strong histories and reliable cash flow for the dividends. While many think that dividend paying stocks are inherently less risky or vulnerable than non-payers, that is not true. The real benefit of dividend payers is that you are not forced to sell shares when they are down in order to create income – you just cash the checks and leave the shares to do what they will.

How Did the Markets and our Funds Do in July 2020?

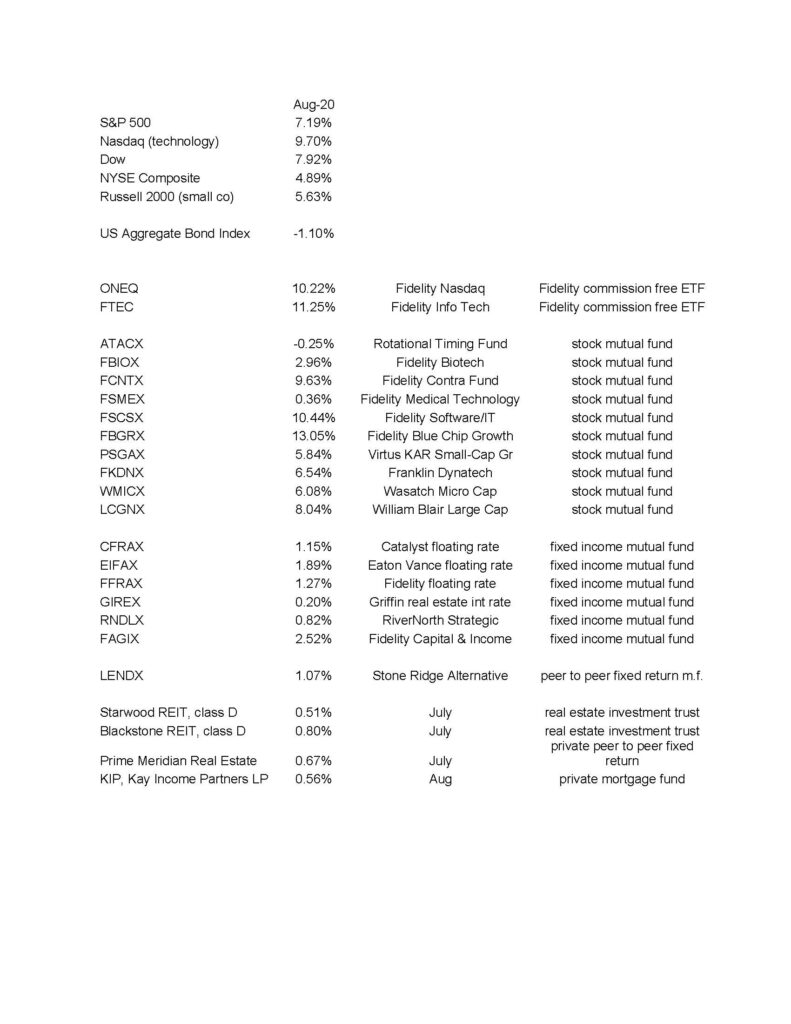

The below numbers are courtesy Morningstar Workstation:

Your investment return(s) for August 2020 was/were as follows:

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.