“Smooth Seas Do Not Make Skillful Sailors” ― African Proverb

“A good head and a good heart are always a formidable combination.” – Nelson Mandela

Current State of the Markets?

In the last newsletter, I talked about whether the June market lows would be the final bottom. We still don’t know the answer, but stocks started to sell off very aggressively on August 22 and it continued right up through Friday. Will we make it all the way back down to the lows we hit in June? No one knows, but for now, it’s all about caution. I do think the odds favor further declines. Of course, it doesn’t matter what I think or why, but since you asked, it’s about inflation, deficit spending, economic weakness, higher interest rates, unfolding global recession and worldwide energy shortages. It’s a supply/demand crisis – demand being destroyed, and supply being impeded. Fill in your favorite causes.

September is seasonally very weak, and I think caution is called for until after the elections, at which point we may be ready for a rally – a “playable bounce” in a difficult landscape. Bear markets tend to show very high gains once they end and patience + defense pay dividends eventually.

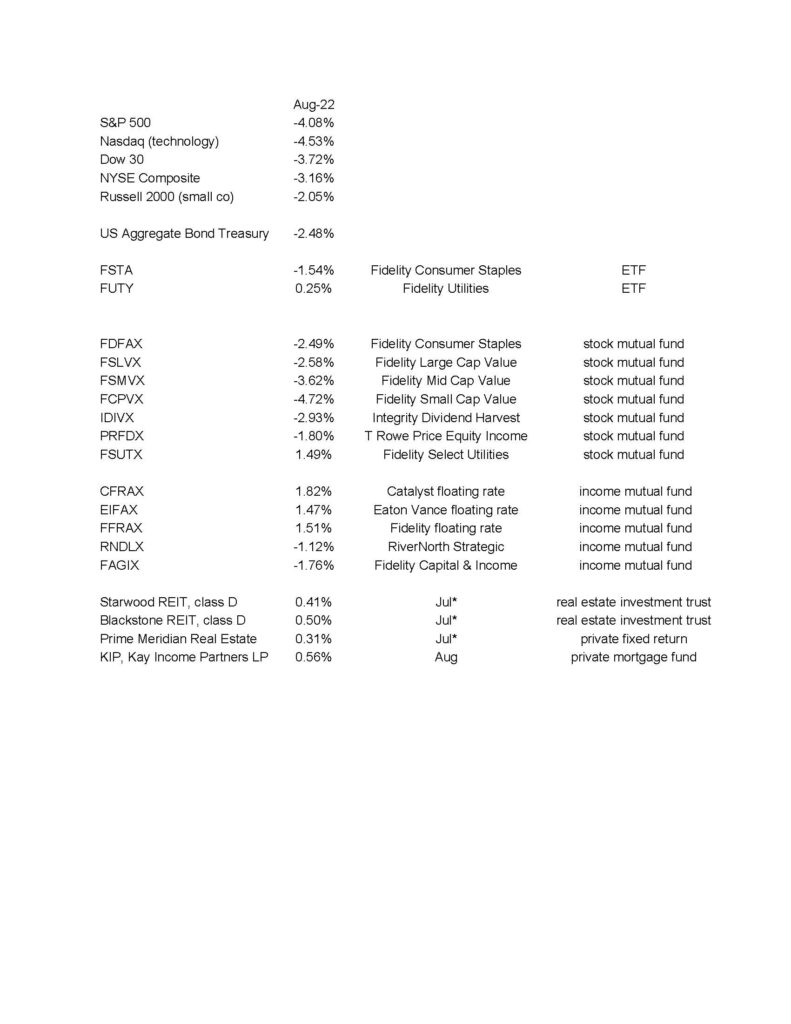

For the month, the general averages were mostly down approximately 4%, plus or minus. We were down around 2%, plus or minus. For those with smaller accounts, we stayed pretty much with the utilities and consumer staples, which also beat the averages.

I implemented a new program during the month of August, for 64 accounts. You may already be in it. I prefer accounts over $200,000 that take advantage of free commissions (may require choosing email for all Fidelity correspondence). I utilize price movement and statistics very carefully. I have a learning curve for sure, but for the entire month we enjoyed better performance (translate: less money lost) than the greater market. As of month end, the program has the accounts holding a large amount of cash – due to the weakness that started after the 22nd.

Many of you are invested in Blackstone and Starwood (BREIT and SREIT) and are grateful that they have made money this year – while diversifying your overall holdings. Blackstone has a new program (as of last year) which pays a pure dividend income of approximately 8.1%. Unlike BREIT, it does not have much appreciation potential and there are no tax deferral benefits for taxable accounts. HOWEVER, it’s a good choice for creating steady, predictable income with minimal volatility. Blackstone does a good job creating these portfolios and is a huge, experienced provider. This “new” program is already about $45 billion in size. Let’s talk about this as a possible option – especially if you like the sound of it.

How Did the Markets and Our Funds Do in August 2022?

(Courtesy Morningstar Workstation)

* 1-month reporting lag