An investment banker asks a fisherman, “What do you do when you’re not fishing”, to which he replies, “I sleep late, play with my children, take siestas with my wife, stroll into the village each evening, where I sip wine and play guitar with my friends. I have a full life.” The investment banker explains how he can show him a plan to make millions in 25 to 30 years, if he is willing to work very hard, make sacrifices and follow the plan. “Okay, then what?” asked the fisherman, to which the investment banker replied: “Then you would retire, sleep late, play with your children, take siestas with your wife, stroll into the village each evening, where you could sip wine and play guitar with your friends”.

Where are we, at the end of December 2019?

How does the stock market (citing the S&P 500) gain over 19% in 2017, lose 6% in 2018 and then bounce back and gain nearly 29% in 2019? Wouldn’t it make more sense to gain around 14% each of those years? And why did the S&P lose over 13% in Q4 of 2018 only to gain over 13% in Q1 of 2019? We would be so much better off if the market would just give us approximately zero percent (0%) for both quarters, right? The ride seems to make no sense. Worse yet, the wild rides down seem to fuel so much speculation that doomsday is finally here for the stock market – which creates stress chemicals in the body. Just let us live a stress-free life!

Here are a few points of perspective: … it’s trite to say, but if the markets were steady, there wouldn’t be as much money to make – we are paid for accepting volatility. …markets are driven shorter term by EMOTIONS, namely fear and greed. This pretty much guarantees volatility. People want to buy when the markets are surging and want to sell when they are tanking. …people currently expect a recession and bear market because historically 11 years is already too long for a major bull market cycle. And yet, there are only approximately a dozen major bear market cycles in the last 100 years. NOT A LOT OF DATA POINTS. If you are doing a statistical analysis of something, you want more than a dozen points of reference. …finally, many people judge stock market prospects by their political views – not rational! Stick to statistics and numbers.

Conclusion: the stock market is known to be a volatile place. Live with that.

How Did the Markets and our Funds Do in December 2019 and for the Year 2019?

The markets made close to 3% for the month and over 25% for the year. That is just amazing. If you are in a moderate or conservative model, then obviously you made less, but even our fixed funds made high single digits. So, you might assume that by the law of averages, 2020 should be a mediocre year. That might or might not be true. Ultimately the whole show is driven by economics and corporate profits, but there is something called “reversion to the mean.” This is another way of saying that eventually a fair coin flips heads and tails about the same number of times. On the other hand, if you just flipped 3 heads in a row, the next flip is still 50-50. So, the verdict is: the statistics aren’t flagging serious bear market yet and the quarterly returns are too unpredictable, so I am just going to keep choosing strong funds and sectors until further notice.

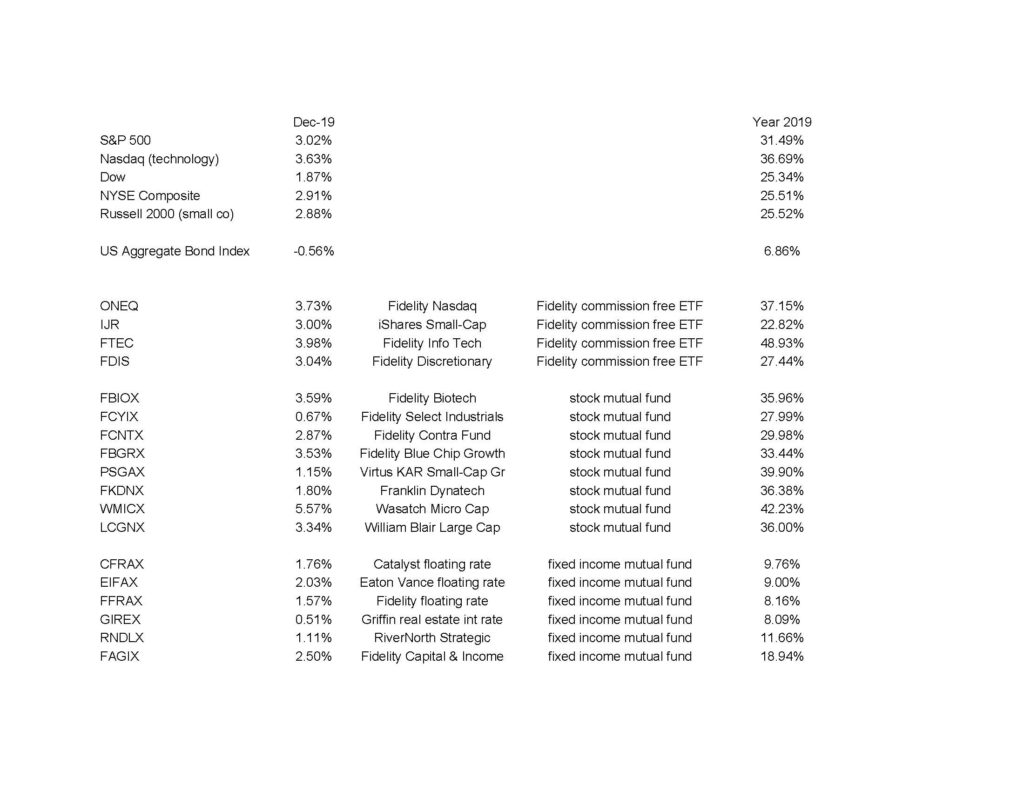

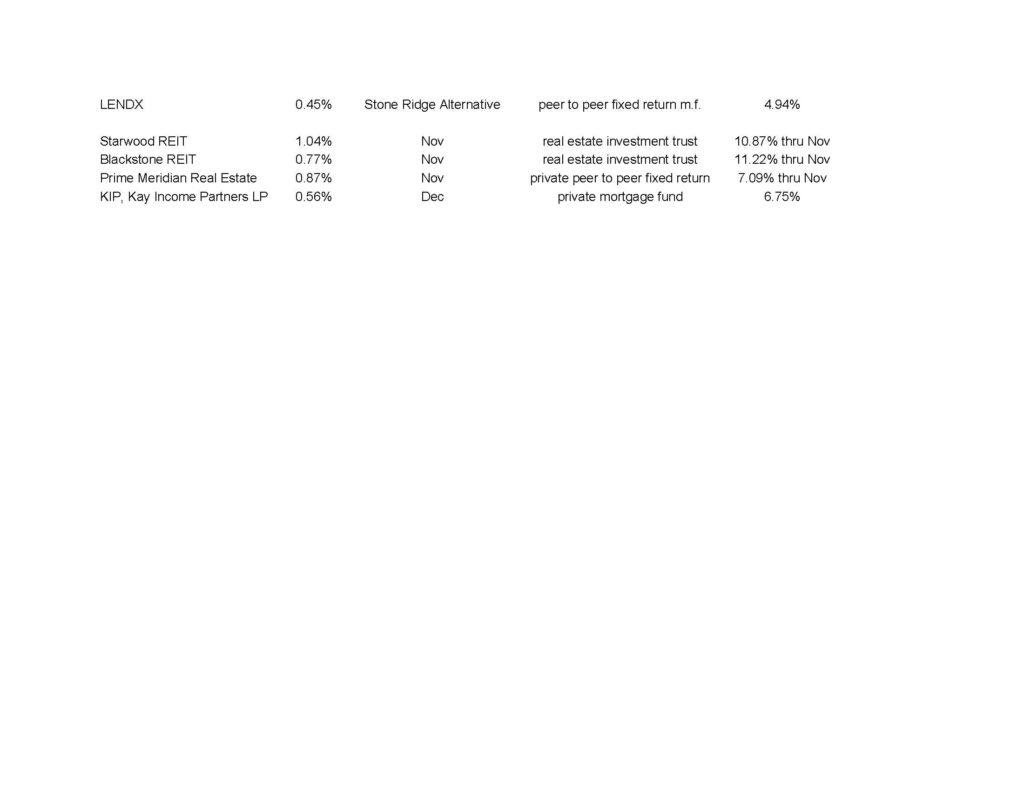

The below numbers are courtesy Morningstar Workstation:

Your investment return(s) for December 2019 and for the year 2019 was/were as follows:

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.

Best,