The stock market may be bad, but I slept like a baby last night. I woke up every hour and cried… (unknown).

In summary, despite its speed and severity, the current market pullback has antecedents in similar market declines over the course of the current bull market [since 2008]. Most importantly, though, there was little evidence of a major top prior to the current sell-off or prior to any of these earlier sharp market declines [since 2008]. Thus, once this pullback runs its course, the probabilities should clearly favor a resumption of the bull market with prospects for additional new all-time highs in the following months…. Lowry Market Trend Analysis

Where are we, at the end of February 2020?

The above quotes are just about equally useful at this point, in deciding what’s going on and what happens in the short term. The markets are in full blown rout right now, dominated entirely by panic selling. The “explanation” is some combination of the collapse in oil prices, fears of the coronavirus and economic slowdown. It’s impossible to know when the panic will stop. Fear and greed control much of the larger, shorter term market moves. Selling now would presume that we could know when to buy back in, at prices lower than today. I feel that selling into panic is much like catching a falling knife. As a matter of perspective, the major stock market indexes have ALWAYS returned to previous highs and resumed making new highs – but it’s a matter of WHEN and how long we wait. I’ve tried to match stock market allocation to the risk aversion and time horizon of the client. This is another way of saying that positions in serious decline now should have time to correct.

As a matter of perspective, it’s important to remember that the S&P 500 index rose over 31% last year, which is FAR, FAR above its typical annual average. This means that it is very possible that last year’s gains may have gone too far. Stock market returns adhere to cyclical ups and downs around a mean (average), with high volatility (swings). A “reversion to the mean” (statistical terminology) would expect an eventual opposite effect in the service of balance and averages. This is true in all manner of outcomes: free throw shooting in basketball, temperatures in July, wind speeds in Chicago and dice throwing at a casino. Some of it is about randomness and some it is about human nature. I believe that the very depth of this decline has something to do with averaging out last year’s gains.

I notice that our floating rate funds lost about a percent last month. I’m not happy about this behavior, which happened also in Q4 of 2018. Because of this, I’ve moved quite a bit of money into REITS, which although obviously not guaranteed, seem to show less correlation to the stock market. Even our excellent fund, the Griffin fund (GIREX) lost about 1%. The fixed funds arena is difficult to navigate in a world of near zero interest rates.

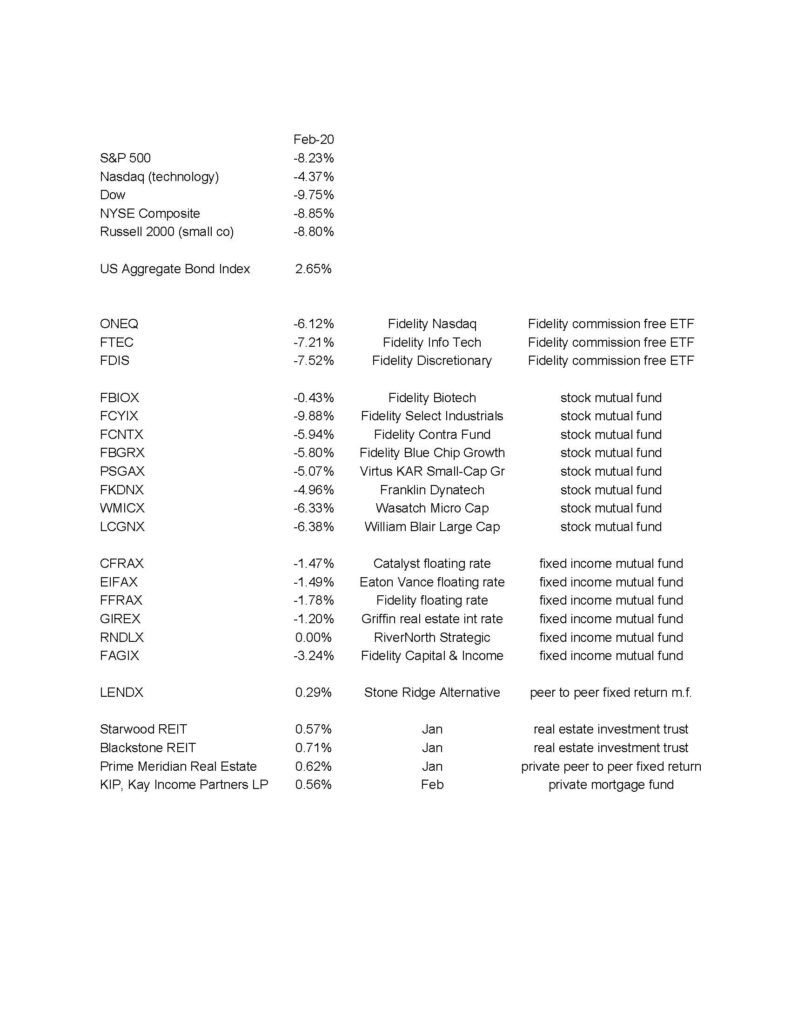

How Did the Markets and our Funds Do in February 2020?

The below numbers are courtesy Morningstar Workstation:

Your investment return(s) for February 2020 was/were as follows:

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.

Best,