Einstein enters Princeton for his first day of work. The Dean leads him to the faculty lounge and begins introducing him to professors. “Here are your first colleagues; they have IQs of over 180”. Einstein says “Wonderful. We can discuss quantum physics”. Another colleague reaches out to shake his hand and remarks “I also lecture here but my IQ is very low”. Einstein smiles back and says: “Where do you think the stock market is headed?”

Where are we, at the end of January 2020?

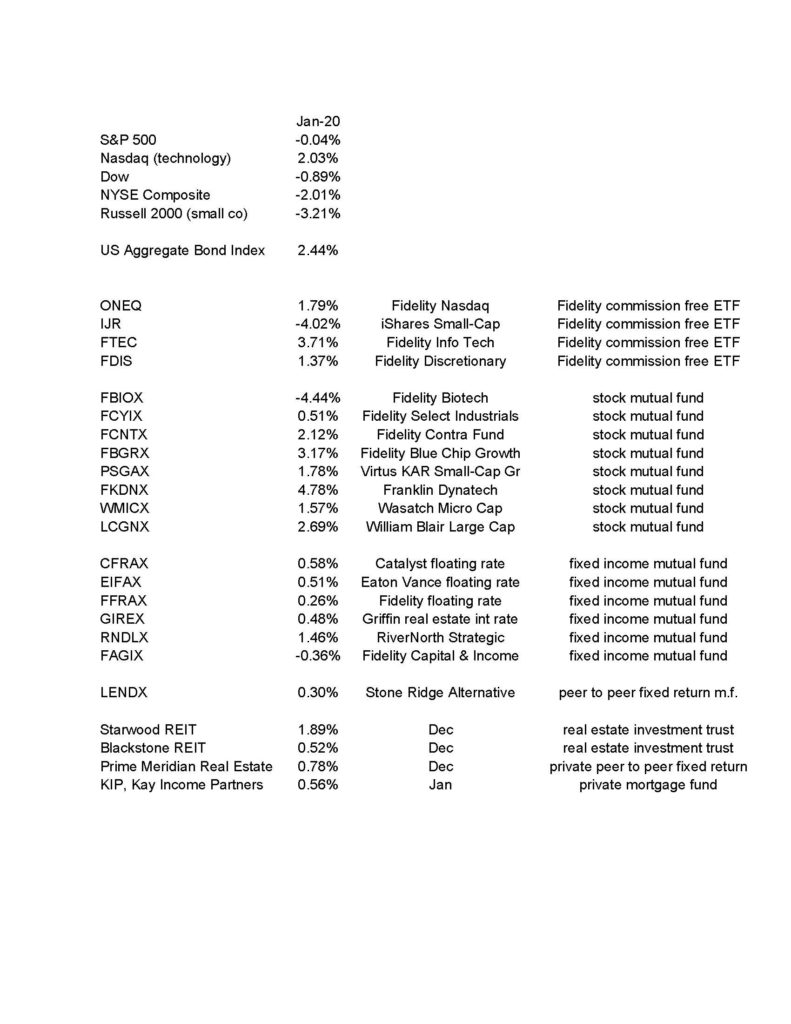

The markets ranged mainly from flat to down in January (see below). The New York Stock Exchange Composite and the Russell 2000 were down over 2% and 3%, respectively. These indexes represent most stocks in our investment universe. The S&P 500 was approximately unchanged and one sector, technology, was up around 2%. Bonds and fixed return funds did well. With all that in mind, it’s a happy thing that virtually all the client accounts were up in the range of 1% and more. This owes to two things: I am emphasizing what is strong (i.e. technology and large company funds) and I am using very good, very well managed funds.

Remember that the stock market seems to average one drop of around 10+% every year, so don’t be surprised if that happens. However, there is nothing showing itself in the way of weakness at present. What causes larger changes and market movements is new, unforeseen information. Since we can’t know what is not yet known, it is difficult to protect against a sudden correction.

Even in the absence of new information, the markets exhale and inhale. There are months when people sell for tax reasons, profit taking or emotional reasons. Then, other months bring buying. As I’ve stated in the past, the market is just a volatile place.

How Did the Markets and our Funds Do in January 2020?

The below numbers are courtesy Morningstar Workstation:

Your investment return(s) for January 2020 was/were as follows:

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.

Best,