“If you don’t know where you are going, you’ll end up somewhere else”….. Yogi Berra

“It’s only when the tide goes out that you discover who’s been swimming naked”…Warren Buffet

“The stock market can stay irrational longer than you can stay solvent”… Unknown

Clients keep coming to me, wondering where we are going with this stock market rally and whether we are, in fact, swimming naked right now. Even one of the trainers where I work out, made a point of asking me if all this Federal Reserve stimulus is going to lead to a reckoning. Others want to know whether the election outcome will be so divisive that it sets fire to the stock market. Remember that the bull market has resumed and bull markets climb a wall of worry.

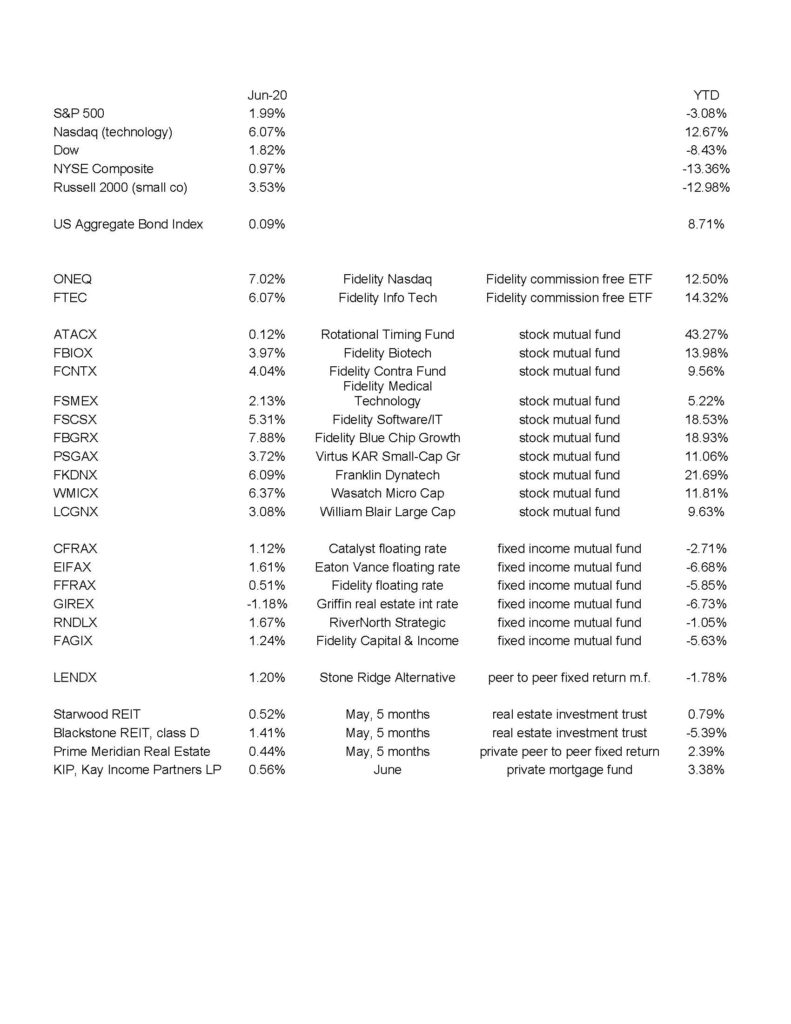

Where are we, at the end of June 2020 and YTD?

I do have concerns myself. One thing that catches my eye is the ENORMOUS difference between the YTD return (see below) of the Nasdaq (technology) index and the NYSE Composite index (average of all stocks on the New York Stock Exchange) – and even the Russell 2000. Some difference is common, but 26% at the 6 month mark??!!. Clearly, tech companies have been winners in the world of COVID, especially the so-called FAANG stocks (Facebook, Apple, Amazon, Netflix and Google). You might think that returns will converge at some point.

Our accounts have ridden this wave, as we have been tech heavy for a number of years. Virtually all our accounts are UP year to date, with the principle exceptions being accounts that are intentionally heavy on monthly income investments.

My position on all the above is simple: the markets are clearly strong, so we need to stay invested. I believe that the markets will give us some warning before something bad happens. It may seem risky, but no one really knows how things will play out. Expecting the markets to be rational is generally a losing strategy – better to let the markets show us what and when.

How Did the Markets and our Funds Do in June 2020 and YTD?

The below numbers are courtesy Morningstar Workstation: