From a trader after the market crash: “This is worse than a divorce. I’ve lost half my net worth and I’m still married.”

Where are we, at the end of March 2020?

There are many things to discuss after the month of March. It was an unprecedented decline in terms of speed and depth (except maybe back to the Great Depression) but even more because it followed directly after new historic highs. Historically, bear markets develop over a period of months.

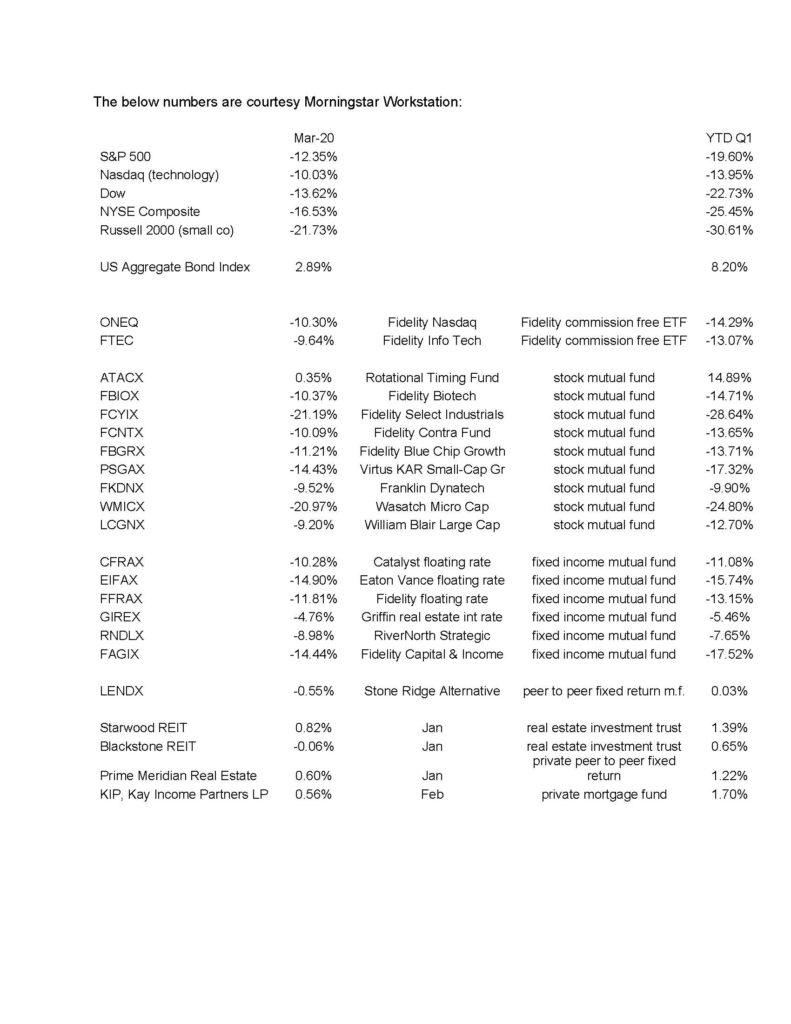

The worst outcomes happened to the smaller company stocks. The Russell index lost almost twice as much as the S&P 500 and more than double the Nasdaq. Smaller businesses and public companies are definitely more vulnerable.

When the market started its descent, I realized that it might be sharp but I thought the recovery might come quick, as soon as the virus curve began to flatten – something like during and after December 2018. At this point, things have changed inasmuch as the economy will not simply bounce back without some permanent damage. There are those who feel the economy may come back in a more efficient, healthier and streamlined form. This viewpoint reminds me of a forest after a fire – lots of destruction but thinned out.

There is also the question of all the money flooding the economy from the federal government. There will eventually have to be an outcome from that. Nothing is free. Unfortunately, many or most people don’t realize that they, all of us, are borrowing this money to pay ourselves, in essence. There is no benevolent donor. I don’t mind saying that the whole situation is a bit mind boggling.

There are scenarios where the stock market could recover and make new highs relatively quickly. Sometimes easy money transfers wealth from main street to Wall Street. The recession that has undoubtedly started is unique historically – much like an induced coma. In fact, we are in a strong upswing now. Since March 23, the S&P 500 is up 21%. Clearly the market sees a probable end to the virus, but I can’t imagine that the market really understands the future recovery of the economy. It seems unknowable.

I made some fund changes. I replaced several funds with the ATAC fund. It is what is called a “rotation” fund. It moves in and out of stocks in an automated way that has been back-tested over many years. It moved out of stocks late in January but back in during the last few weeks. There have been past periods where it has been “spot-on” (such as 2020) and there have been periods where the stock market has been strong while its performance has lagged. Currently, I think it’s well placed.

I have had no plans to move positions to cash because the current environment is without precedent or insights. The only moves I’ve contemplated thus far have been with ATAC. If someone, for reasons of “sleep factor”, decides that he/she wants to sell, that person needs to contact me to discuss that.

My final point is regarding fixed funds. The usual fixed return mutual funds, as you can see below, were hurt in March. My efforts to diversify accounts into Blackstone and Starwood have so far been excellent moves. Their dividends are likely to stay perfectly stable. Their unit prices may be affected but probably only marginally and if so, it should be temporary.

Every investment and fund has a cost and benefit relationship. With the stock funds, time is the healer. For those using their funds for income, the plan is to trade some liquidity of principal for stability of income using private REITS. I use the fixed return mutual funds to create some diversification but in a crash scenario, they have only cushioned losses marginally.

How Did the Markets and our Funds Do in March 2020?