“The average man/woman is both better informed and less corruptible in the decisions he/she makes as a consumer than as a voter at political elections.”. – Ludwig von Mises”

Where are we, at the end of March 2022?

The problem with reporting the returns of the S&P 500 as a representation of the stock market is that half of its weight and investment return is created by only 10 companies (the 500 companies are not equal weighted!). Usually, when the economy is headed for trouble, money heads in the direction of very large, established stocks, for hoped for safety. Appearances can give a false sense of security. This was the case in 2007 – 2008, when the big companies tumbled last. Readers of the news may also be aware of the “yield curve inversion”, an apparent warning sign of coming recession. This happens when short term interest rates (currently being raised by the Federal Reserve in response to inflation) are higher than long term rates. That signal is generally accurate but can be 2 years in the making. Interestingly, the stock market often does great during the intervening time.

As usual, all the above means we live in interesting and rather unpredictable times. In addition, the bond market is tumbling, and it’s been difficult to make money with fixed funds! We have averaged between breakeven and 1% on our fixed returns (thank you dividend payers). Even Starwood and Blackstone “only” returned 1+% for their most recent month. I do NOT consider the March numbers to be proof that this correction is over.

In March, I added the Astoria Inflation Protection ETF (PPI) to almost every account. As the name implies, it consists of companies that are positioned to benefit in times of inflation. I also added or increased holdings in energy for almost every account. These are hedges. (Note that if you are in a moderate or conservative portfolio, the stock returns are mixed with fixed returns). Notice the wide disparity in returns among some very good funds.

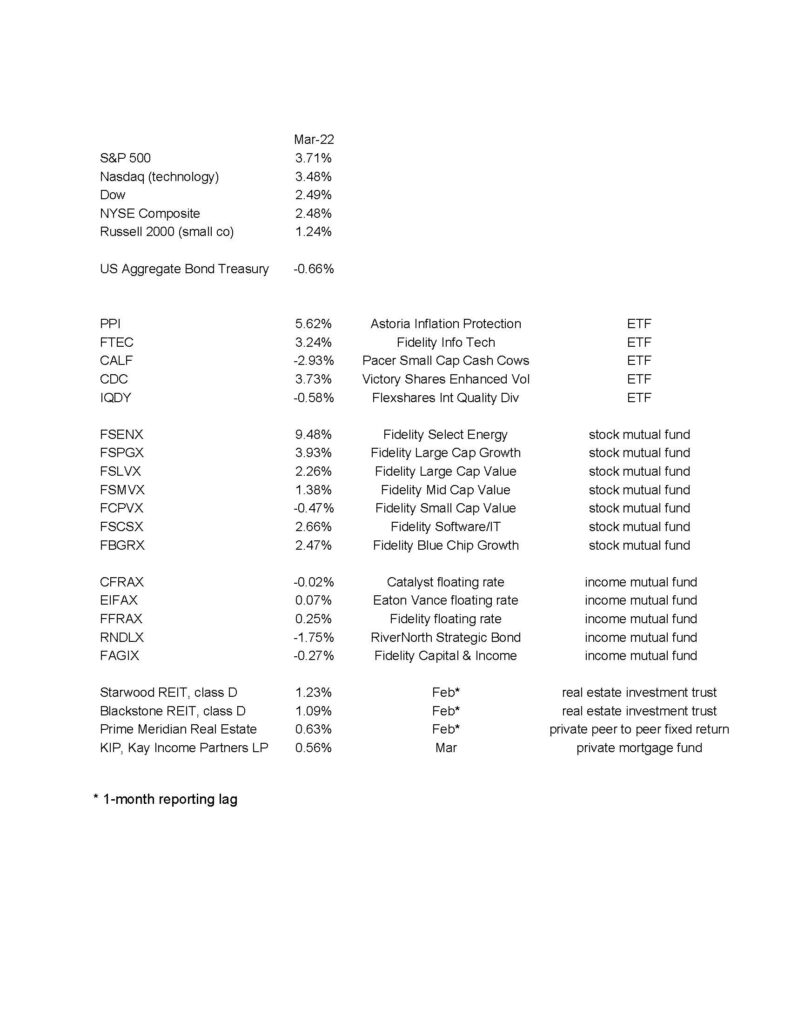

How Did the Markets and Our Funds Do in March 2022?

The below numbers are courtesy Morningstar Workstation: