After years of scrimping and saving a husband told his wife the good news: “Honey, we’ve finally got enough money to buy what we started saving for in 1979.” “You mean a brand-new BMW?” she asked eagerly. “No,” said the husband, “a 1979 BMW.”

And then you have this aphorism: “Modern Slaves Are Not In Chains, They Are In Debt.”

Where are we, at the end of November 2019?

Curiously, I liked the above joke for an odd reason – people talking about buying something AFTER they’ve saved for it, however paltry. More likely today, people buy something bigger, using debt. Hence the aphorism that followed.

Let me apologize for being later than usual with this newsletter. I was out of town pretty much all of last week and then very tied up this week doing last week’s work.

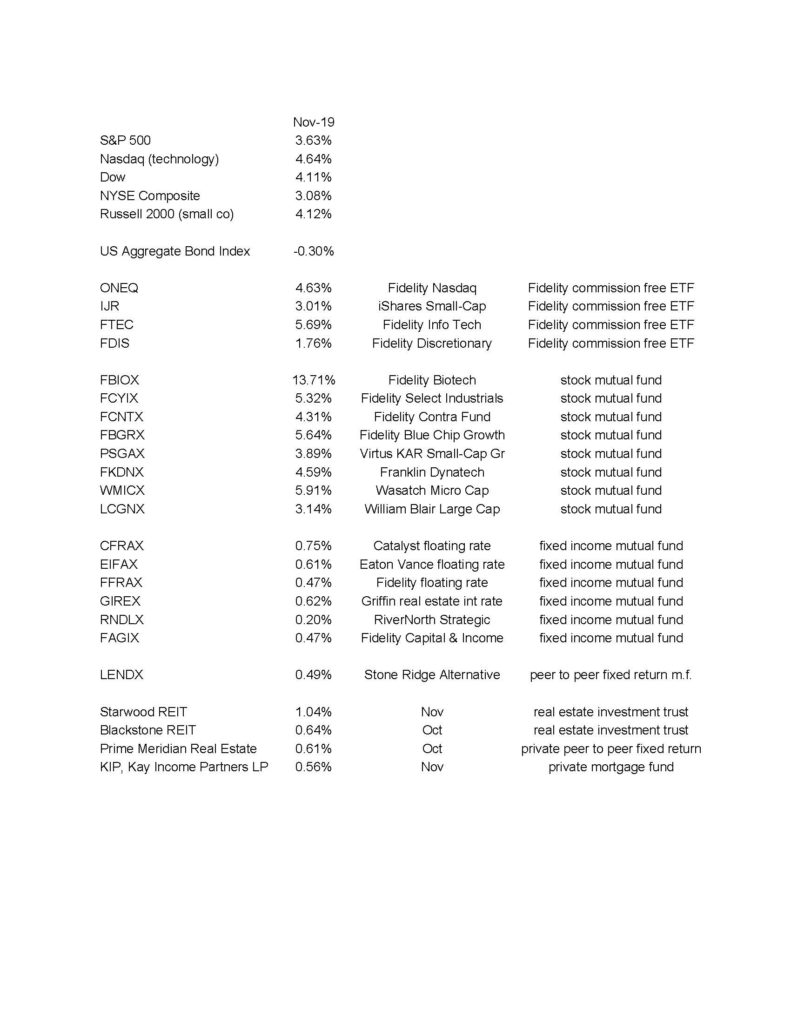

HOWEVER, the month of November was nearly perfect, setting us up for a great finish to a great year. There is just, simply, nothing that didn’t make us money last month. Even the fixed return funds did great. Sometimes when one sector or segment rises, another falls, possibly because money flows from the one to the other. However, in November money flowed into everything.

Our fixed funds all beat the Bond Aggregate Index (see below). The REITS, specifically Blackstone and Starwood, continued to behave very well as they have all year. I don’t have the Blackstone formally for November yet, but do show Starwood. The public offering of the Broadmark, the high performing REIT that I have discussed with many of you, happened. Unfortunately, the security (symbol BRMK) has been trading at a high premium above its net asset value (my estimate 15% premium).

How Did the Markets and our Funds Do in November 2019?

Your investment return(s) for November 2019 was/were as follows:

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.

Best,