American capitalism: “You have 2 cows. You sell 3 of them to your publicly listed company, using letters of credit opened by your bank, then execute a debt/equity swap with an associated general offer so that you get all 4 cows back, with a tax exemption for 5 cows. The milk rights of the 6 cows are transferred via an intermediary to a Cayman Island company secretly owned by the majority shareholder who sells the rights to all 7 cows back to your listed company. The annual report says the company owns 8 cows, with an option on 1 more”…. Unknown

Lowry Market Trend Analysis, 11/1/2019: “In summary, the dominant trends in Supply and Demand, along with expanding breadth and improving strength in Small Cap stocks, all suggest a bull market that remains alive and well”.

Where are we, at the end of October 2019?

There is so much chatter out on the media about socialism vs capitalism today, I thought I might goof on it a little. No matter how serious, you have to be able to laugh….

However, to be a bit serious on today’s stock market, I do study the Lowry statistical analysis of supply and demand. I look for the “telltale” signs of major stock market deterioration. At this point, it seems we remain on the right side. Various indexes are hitting new highs today.

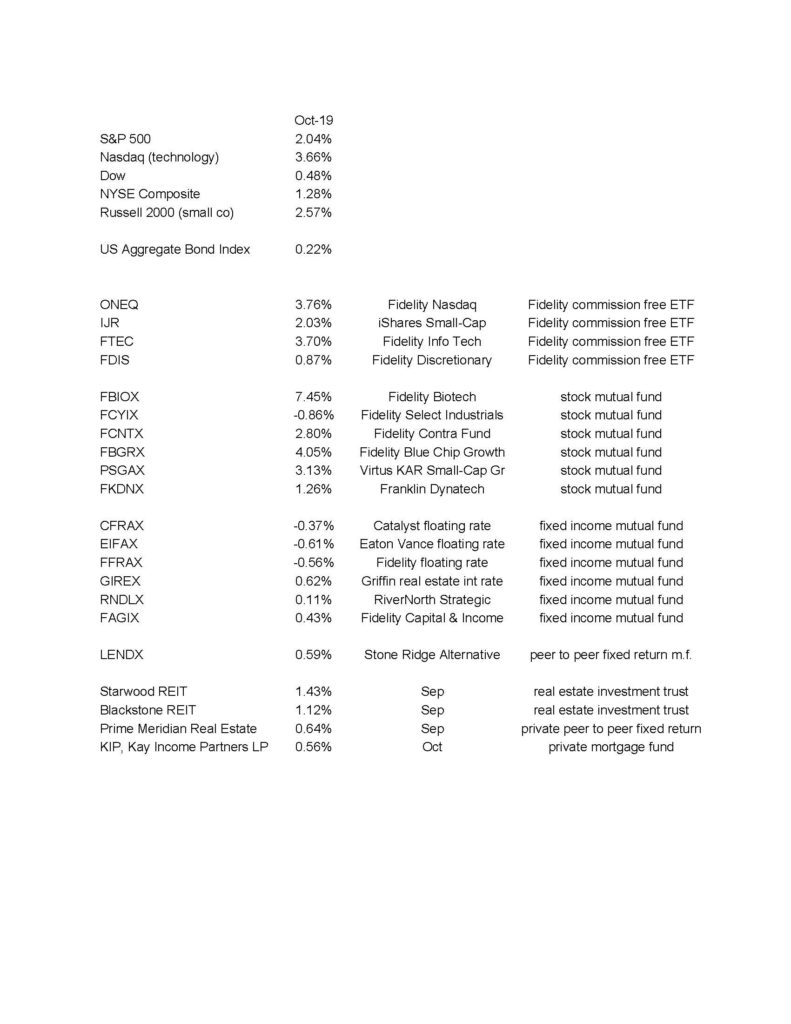

How Did the Markets and our Funds Do in October 2019?

It was a rebound month, pretty much erasing losses from September, when every index except the S&P 500 was down. The Fidelity Blue Chip fund rose 4%, which put it very solidly back on track, the Fidelity Biotech fund rose over 7% and the stock funds in general made us “happy campers”. On the other hand, the floating rate mutual funds were generally down (although up nicely for the year) and remind us that they are just not going to be “up-every-month” investments. This is why we have embraced the REITS, specifically Blackstone and Starwood, which have behaved very well this year. The public offering of the Broadstone, the high performing REIT that I have discussed with many of you, is still on track to happen before year end.

All index and fund returns are courtesy morningstar.com and fidelity.com. Here are the index returns and our fund returns:

Your investment return(s) for October 2019 was/were as follows:

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.

Best,