“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money” – Milton Friedman

“We don’t have a global inflation problem… China, Japan and Switzerland also face elevated oil prices, supply-chain problems and fallout from the war in Ukraine, but their annual inflation rates are 2.1%, 2.5% and 2.5%, respectively. They have avoided the ravages of inflation because their central banks haven’t produced excessive quantities of money.” – Wall St Journal, June 5, 2022

The Stock Market: What’s Going On?

Much has happened since my last newsletter. April was a bad month and May was becoming even worse. I actually wrote a special newsletter on May 20, letting people know my thoughts and the actions I was taking. At the time, the S&P and Nasdaq were down a lot. Then, the current rally started, so it seemed just as well to wait.

Here is what I have done this year and what I have not done: I’ve eliminated all growth and technology funds in favor of safer funds that naturally feature dividends and stability, and I’ve added holdings that benefit from inflation and rising energy prices, such as Fidelity Select Energy (FSENX), Astoria Inflation Protection (PPI) and Victory Shares Enhanced Volatility (CDC). What I have not done is move the accounts at least partly to cash. Knowing when to sell into cash and when to buy back in is very difficult. The markets can gain or lose 10% in a matter of days. The aforementioned funds are actually making money this year and that’s a good thing. In fact, energy stocks are still relatively underpriced, even considering the large runup this year.

Our floating rate funds lost money. This has been very frustrating because USUALLY fixed return funds diversify stock funds and help protect against declines. It seems that every month I comment on how we live in strange times.

Whether this downturn becomes a recession is the question driving the markets up and down right now. There are differences of opinion on both sides, as there always are – if everyone agreed, stock prices would already reflect that agreement. My own opinion favors the recession argument because inflation is only becoming worse. Inflation bedevils forward planning and can easily lead to overexpansion by business which then leads to corrective contraction, which is what a recession represents. The Federal Reserve is raising interest rates in an attempt to cool off inflation, but an increase in the cost of money hurts businesses that rely on credit lines and loans in order to grow and create products. Everyone (including home buyers) was living in a world of near zero interest rates and now things are very different. The slowdown begins with consumers and then moves to businesses.

Those of you who read this newsletter regularly will remember me bemoaning the printing of money over the last 2+ years. It’s simple economics. Print money – get inflation. If it weren’t so, we could simply print everyone into multi-millionaire status.

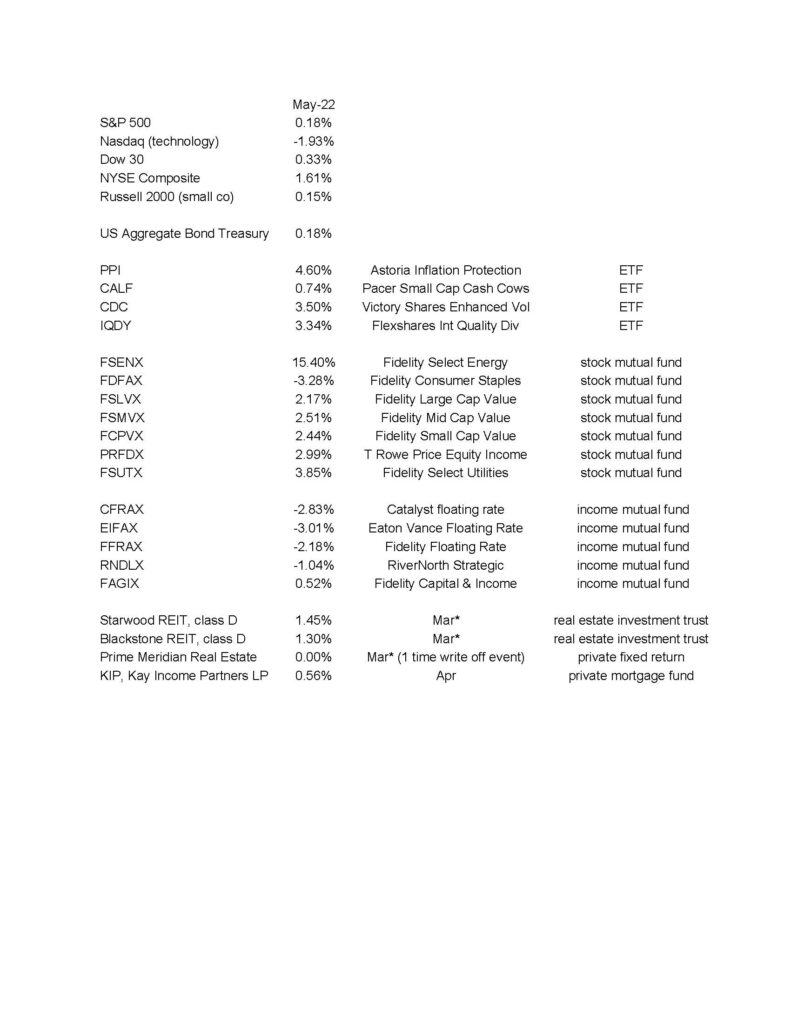

How Did the Markets and Our Funds Do in May 2022?

The below numbers are courtesy Morningstar Workstation: