“Until [and assuming] the evidence changes, diversified investors should not fall for the siren song of the indexes that are rising on the backs of just a few [companies].” – Lowry’s Institutional Market Analysis “Everything should be made as simple as possible, but not simpler” – Albert Einstein How Did the Markets and Our Funds Continue Reading >

September 2022 Performance and Investment Commentary

“…the number of stocks in deep bear markets, 30% or more below their highs, reached ever greater levels last week. If a market is on the mend, or even about to turn higher, this figure should contract, not expand” ― Lowry’s Institutional Research Analysis 10/07/2022 “…the weight of evidence, does not yet support the beginnings Continue Reading >

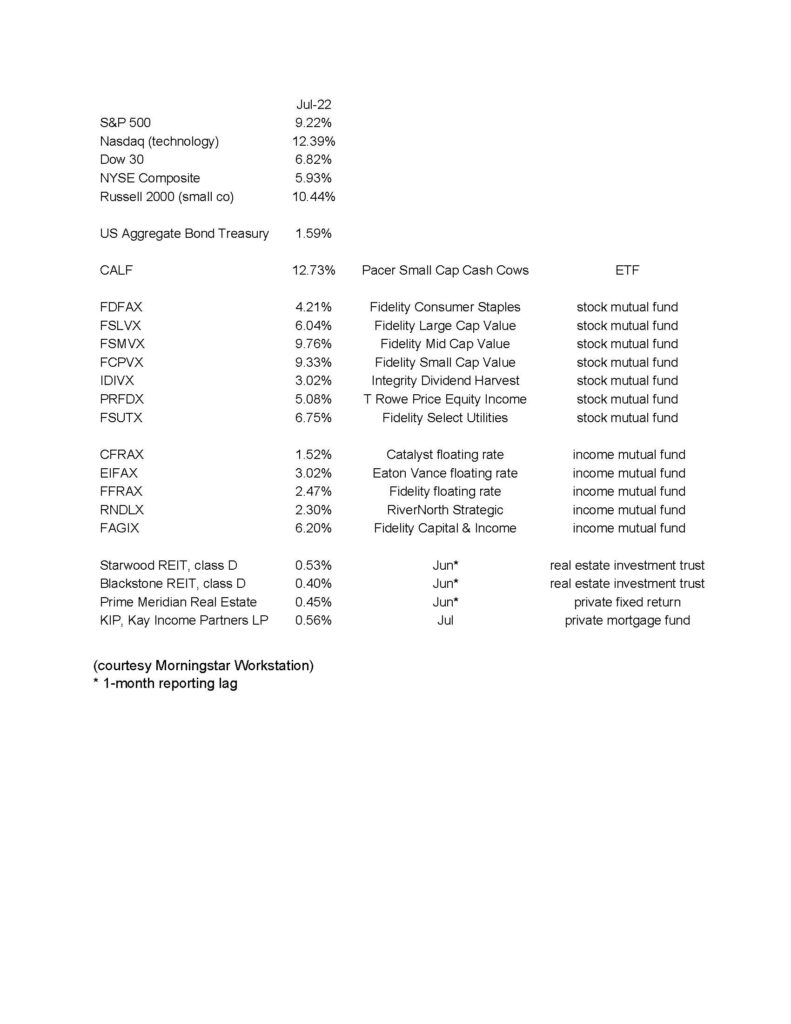

July 2022 Performance and Investment Commentary

“The truth is rarely pure and never simple.” ― Oscar Wilde, The Importance of Being Earnest “Politicians are like diapers, they need to be changed often, and for the same reasons.” – Mark Twain The Stock Market: Is the Decline Over With? This is what everyone wants to know, along with questions about inflation, recession, Continue Reading >

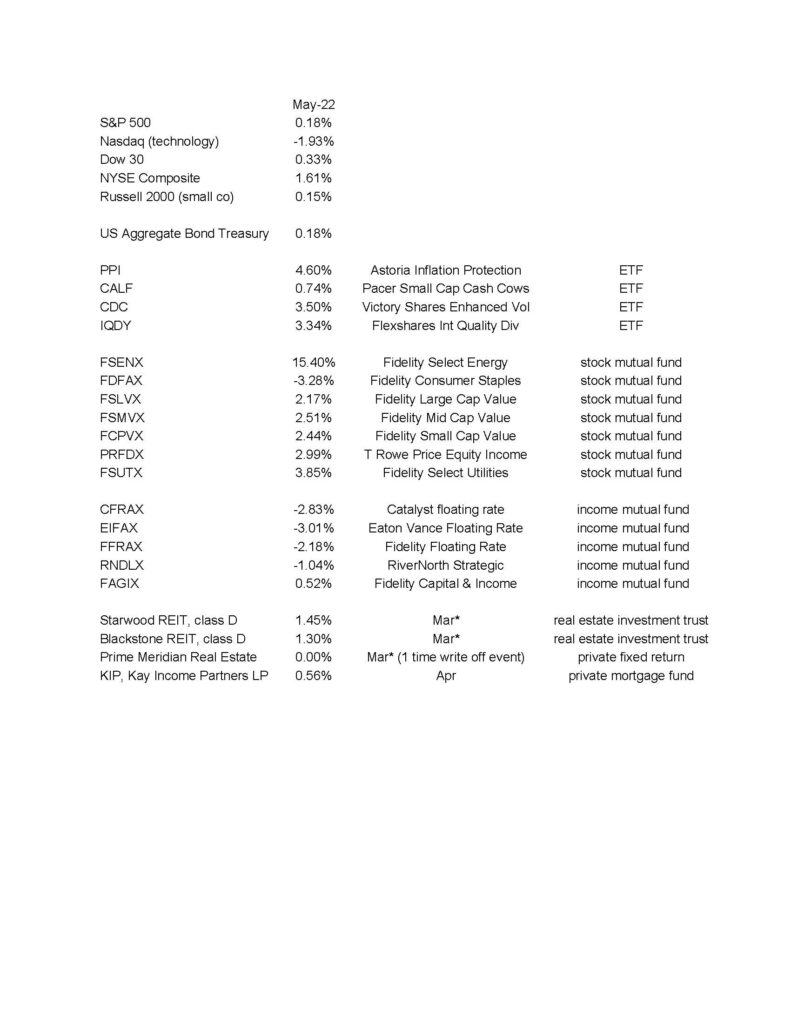

May 2022 Investment Performance and Commentary

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money” – Milton Friedman “We don’t have a global inflation problem… China, Japan and Switzerland also face elevated oil prices, supply-chain problems and fallout from the war Continue Reading >

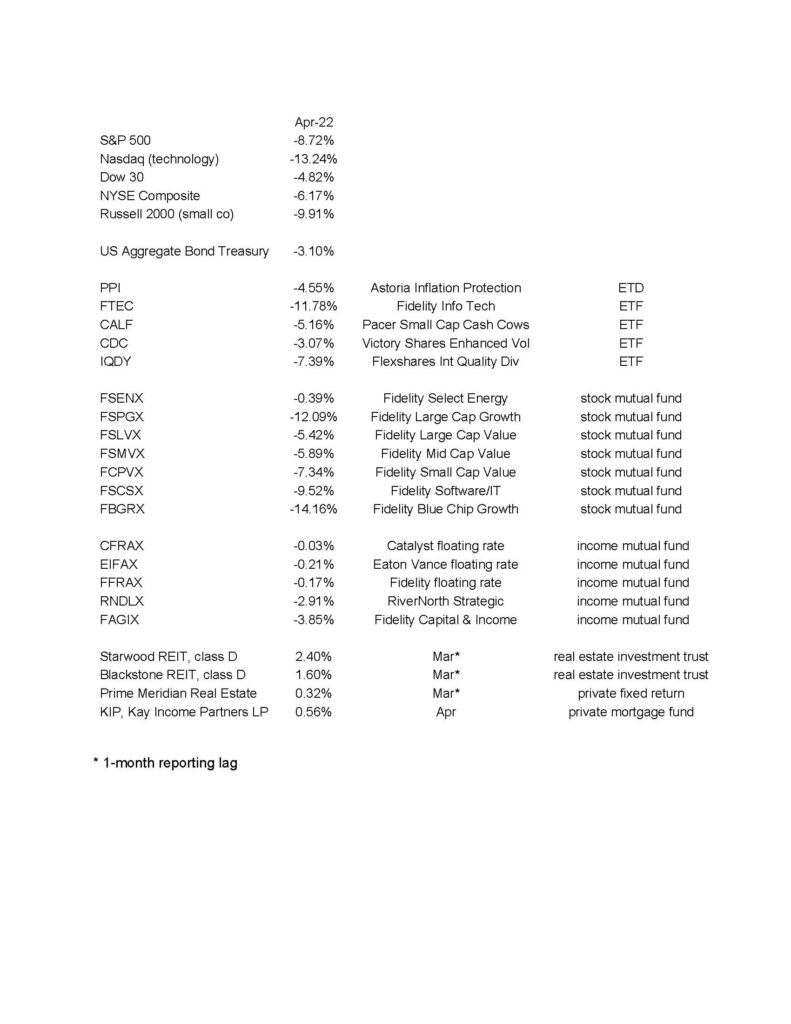

April 2022 Fund Performance and Investment Commentary

“In the midst of chaos, there is also opportunity.” – Sun-Tzu, The Art of War Where are we, at the end of April 2022? April was a hard, down month for the stock market, but it also depended on what holdings and sectors you were invested in. I haven’t yet switched TOTALLY out of technology, Continue Reading >

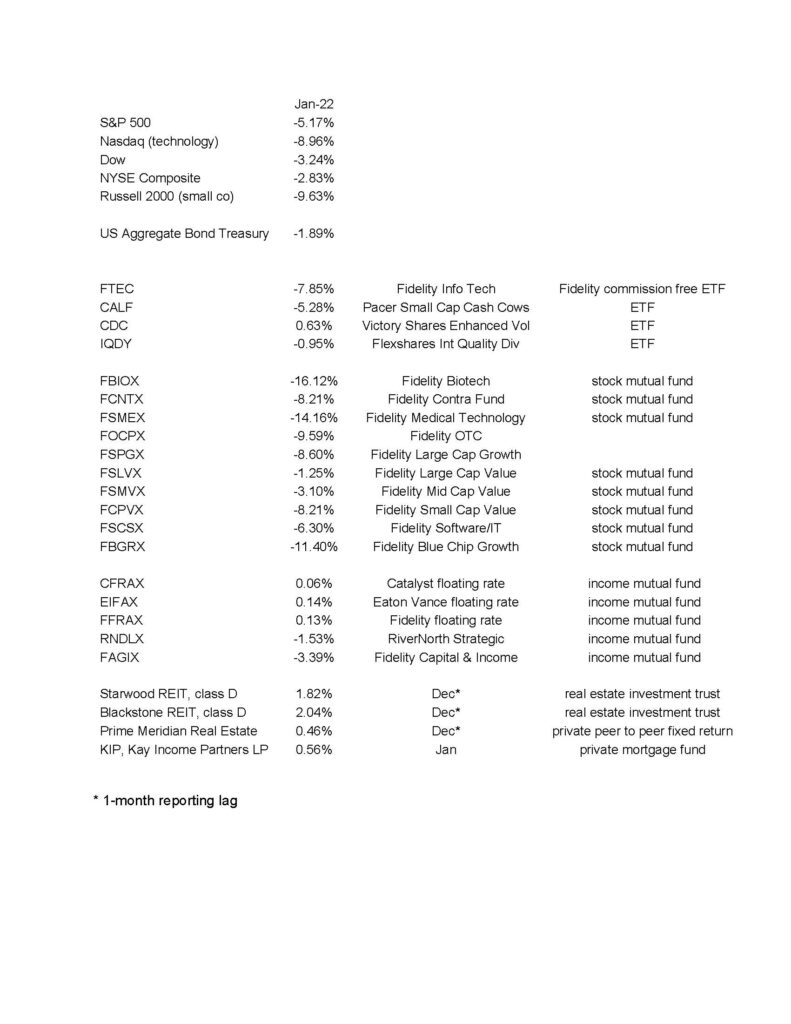

January 2022 Investment Commentary

“He/she that would live in peace and at ease, must not speak all he knows or judge all she sees.”. – Benjamin Franklin, Poor Richard’s Almanack, 1736 Where are we, at the end of January 2022? The month of January was brutal for the stock market, even considering that month-end was sharply higher. January seemed Continue Reading >

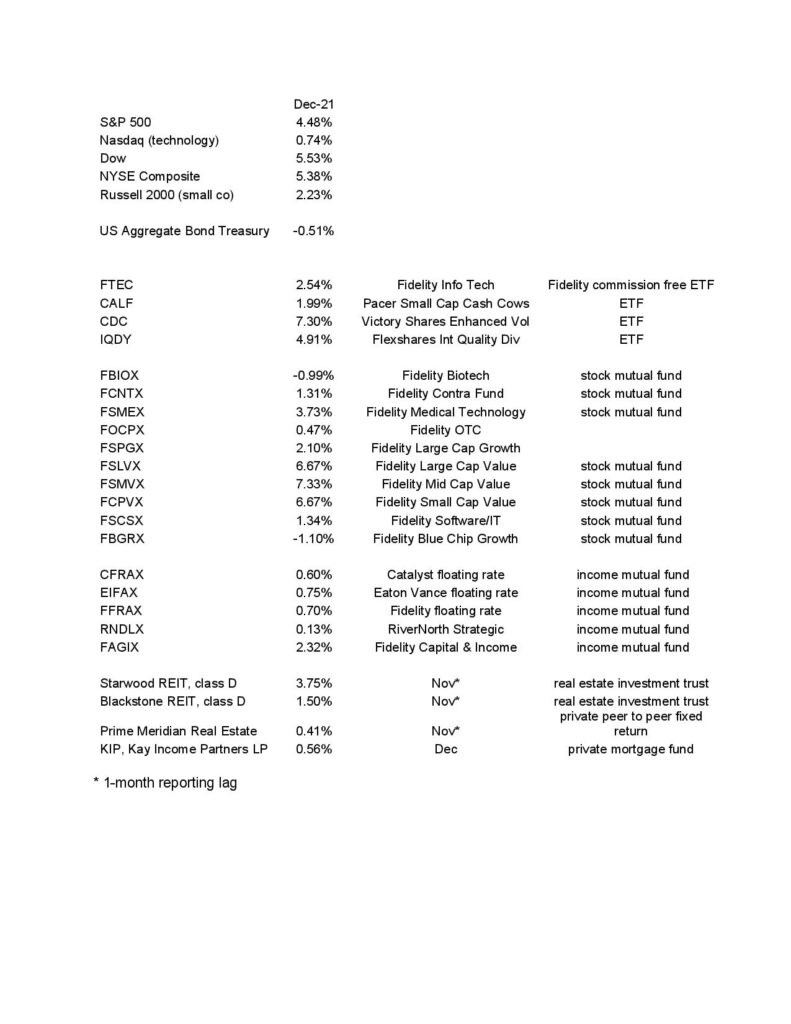

December Investment Commentary and Performance

“If you can’t explain it simply, you don’t understand it well enough.” – Albert Einstein Where are we, at the end of December 2021? The funds that led the way in November lagged badly in this month. The great development is that the smaller companies led the way, which is a HEALTHY development. No healthy Continue Reading >

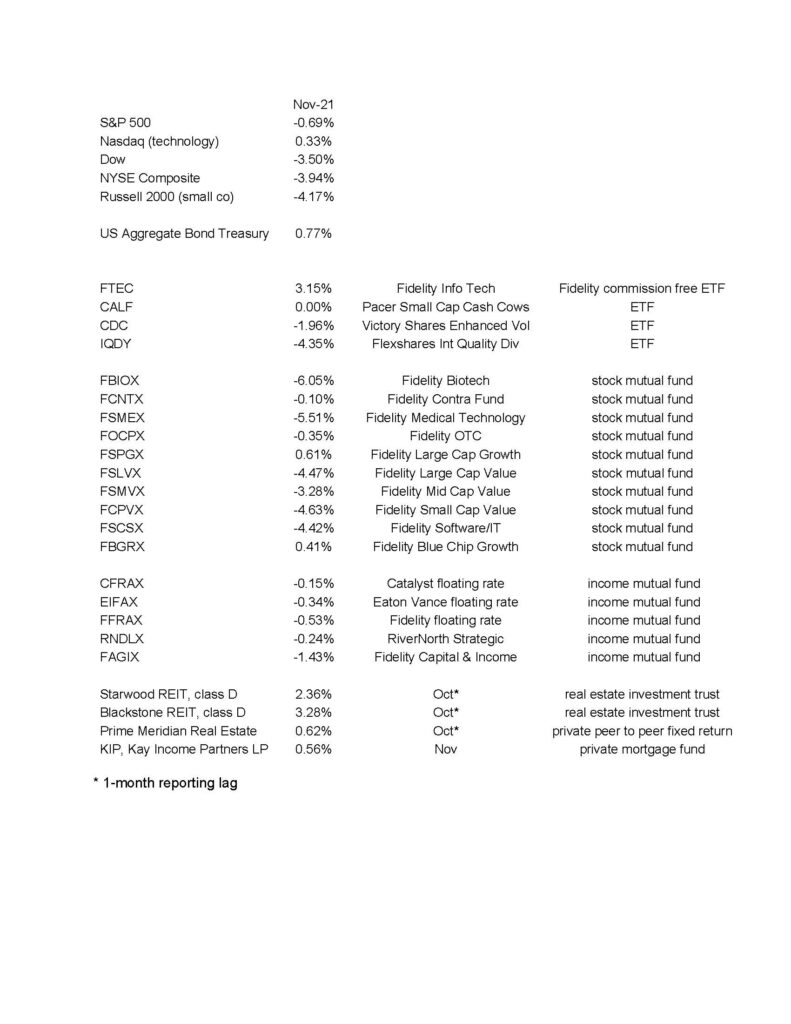

November 2021 Account Performance and Investment Commentary

“It’s not that I’m so smart. But I stay with the questions much longer.” – Albert Einstein Where are we, at the end of November 2021? The months seem to be alternating up and down and the questions persist about future developments. I’m accustomed to seeing divergences, but in November it seemed ridiculous. The vast Continue Reading >

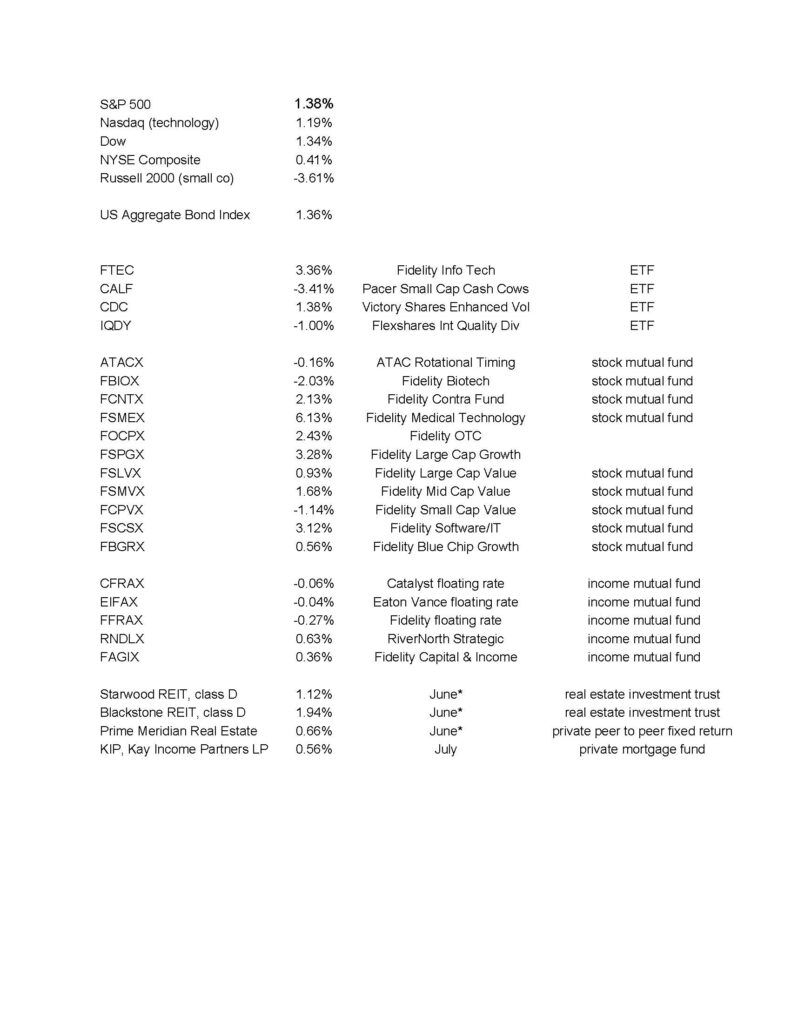

October 2021 Commentary and Account Performance

“One of the great mistakes is to judge policies and programs by their intentions rather than their results.” – Milton Friedman “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” Sam Ewing, former pro baseball player. Where are we, at the end Continue Reading >

August 2021 Account Performance and Commentary

“A good leader takes a little more than his share of the blame, a little less than her share of the credit.” – Arnold H. Glasow Where are we, at the end of August 2021? All the stock market indexes were up nicely in August. The NYSE Composite index was up 1.5%, representing the AVERAGE Continue Reading >