“He/she that would live in peace and at ease, must not speak all he knows or judge all she sees.”. – Benjamin Franklin, Poor Richard’s Almanack, 1736

Where are we, at the end of January 2022?

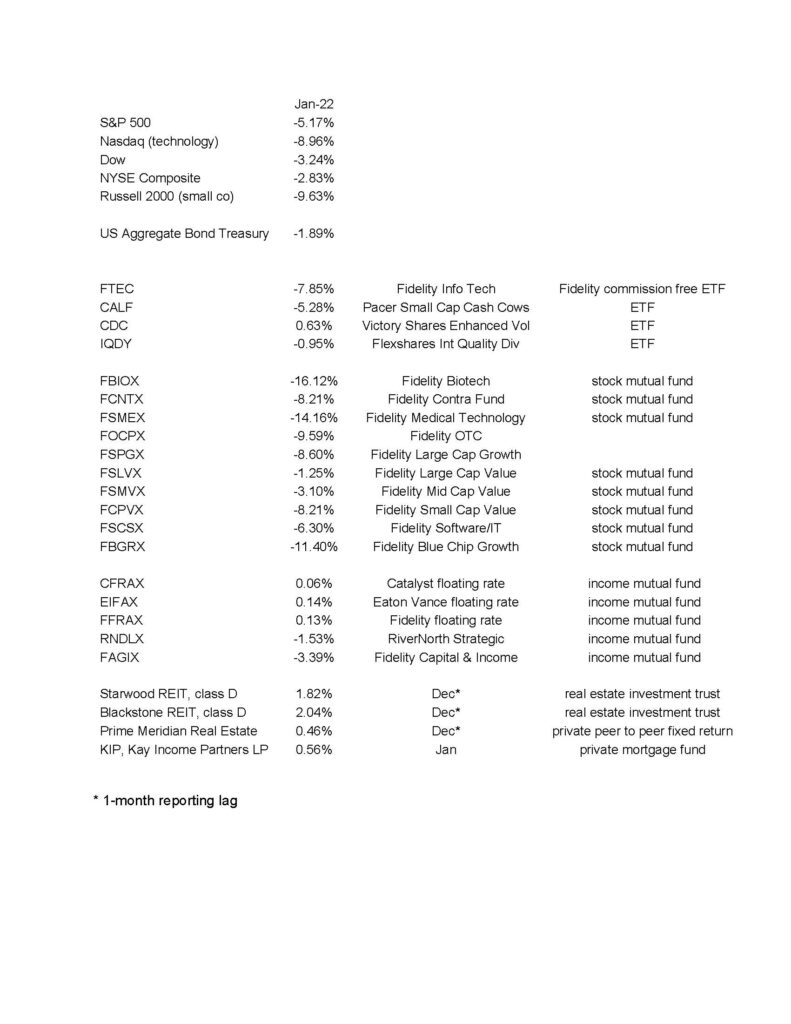

The month of January was brutal for the stock market, even considering that month-end was sharply higher. January seemed to confirm that there is a shift underway that may not snap back the other way – Nasdaq was down about 9% while “value” stocks (look at Fidelity Large Cap Value, below) were down much less or down only marginally. That’s a HUGE difference. It is troubling also that the Russell 2000 (small companies) was down about 10% – small companies should lead the way in a healthy bull market. So, our diversified portfolios reflect all of this to varying degrees but overall, it was a bad month – possibly portending trouble ahead.

We have not had a true bear market year for a very long time. Could 2022 be the year? As I’ve said many times, bear markets are a PROCESS, meaning they don’t just happen in a hurry. Be assured that I will be watching.

Interestingly, our dividend paying stocks were hurt the least of everything we hold. Why was that? I believe that investors feel that well established, dividend paying companies and securities are the best defense against inflation and uncertainty, which is our fate right now. If you are in a 401K, your account did much better if you are in a brokerage account, where we are able to hold dividend payers.

How Did the Markets and Our Funds Do in January 2022?

The below numbers are courtesy Morningstar Workstation: