“The truth is rarely pure and never simple.” ― Oscar Wilde, The Importance of Being Earnest

“Politicians are like diapers, they need to be changed often, and for the same reasons.” – Mark Twain

The Stock Market: Is the Decline Over With?

This is what everyone wants to know, along with questions about inflation, recession, disease and just about everything else. On the subject of the stock market, there is much evidence, based solidly on market history and statistics, that the current rally is not likely to last. HOWEVER, it might. My biggest problem with market statistics and history, is that the history of bear markets does not amount to hundreds of data points, but maybe two or three dozen at most – every so many years, looking back some number of decades. Statistical analysis commonly wants hundreds of data points, if not more. The same ideas pertain to recessions where certain statistics predict a very deep slide and others predict something shallow. And of course, would our politicians know, and would they say?

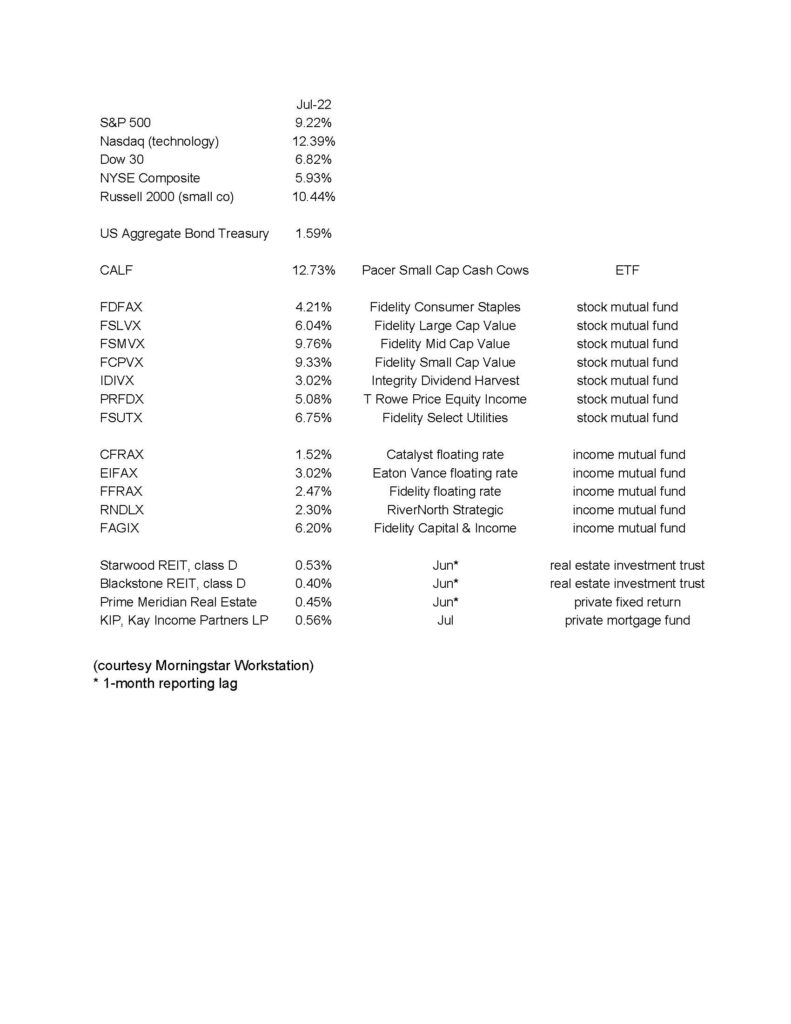

June was horrific and July was excellent – although the New York Stock Exchange Composite lagged behind the more focused sectors. I had gone partially to cash and partially to “safer” funds such as consumer staples and utilities. Who could know in late June that this rebound would take place and how far it might run?

I’ve started to implement something new and different in most of the accounts (larger accounts). I’ve created a group of currently very strong funds (and Apple stock) within the accounts which I can buy and sell much more nimbly. I’m able to do it using my own software. For now, this group includes a Utility fund, an S&P 500 fund, a Nasdaq 100 fund, a small company fund and Apple stock (FUNY, SPY, QQQ, IWO and AAPL respectively). I am watching these daily with specific controls on them for strength and weakness. I will add to this group gradually, sell them as necessary and periodically rotate to stronger funds. If this concept works, i.e. keeps us away from a major decline while making us more money during periods of strength, then I will expand its percentage of holdings in the accounts. At the same time, I’ve sold, or am selling the other ETFs that I’ve held more for safety, but which obviously missed most of the July rally. They are transforming into this new program.

Other than this, the accounts remain positioned predominantly in “value” funds, which have been stronger and safer this year than “growth”. However, in July, as you can see below, they were not as strong – therefore I am creating some representation in technology and growth again. Our fixed funds made money, just much less than the stock funds.

Final point, even if this is just a bear market rally, it could still last for a period of months, and we just cannot afford to miss it.

How Did the Markets and Our Funds Do in July 2022?