“One of the great mistakes is to judge policies and programs by their intentions rather than their results.” – Milton Friedman

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” Sam Ewing, former pro baseball player.

Where are we, at the end of October 2021?

Of course, the many trillion-dollar rescues and programs over the last 20 months were well intended; yet as investors, we need to be prepared for inflation, since printed money inevitably takes us there. What is worse yet is that inflation feeds on itself – as people see prices rise, they rush to buy goods before prices rise even more, which creates a spiral. The situation is further worsened by supply shortages and artificially low interest rates – if money is super cheap, you borrow, you mortgage and you buy, especially if you think things will cost more next month. If you like wild, high scoring football games with lots of lead changes, turnovers and penalties, we have a good one going on.

So, what to do? The stock market historically helps the effort to cope with inflation because stocks respond like hard assets. The danger is that inflation distorts. It becomes difficult to distinguish between healthy, growing demand for goods and the spiraling effects of people chasing goods. Eventually the music stops, and this is exactly how many recessions occur.

Although the stock market seemed strong across the board last month, internal metrics were not ideal. The best indications in October were that the averages rebounded in proportion to their September losses. For example, technology lagged in September but led in October. The NYSE and Russell 2000 indexes, usually the best overall indicators of general health, rose less. I moved out the ATAC fund in favor of positions in energy, financials and medical equipment. Our energy fund, bought partly as an inflation hedge, is up more than 6% already as of today. Medical equipment is up 5.5% since purchase.

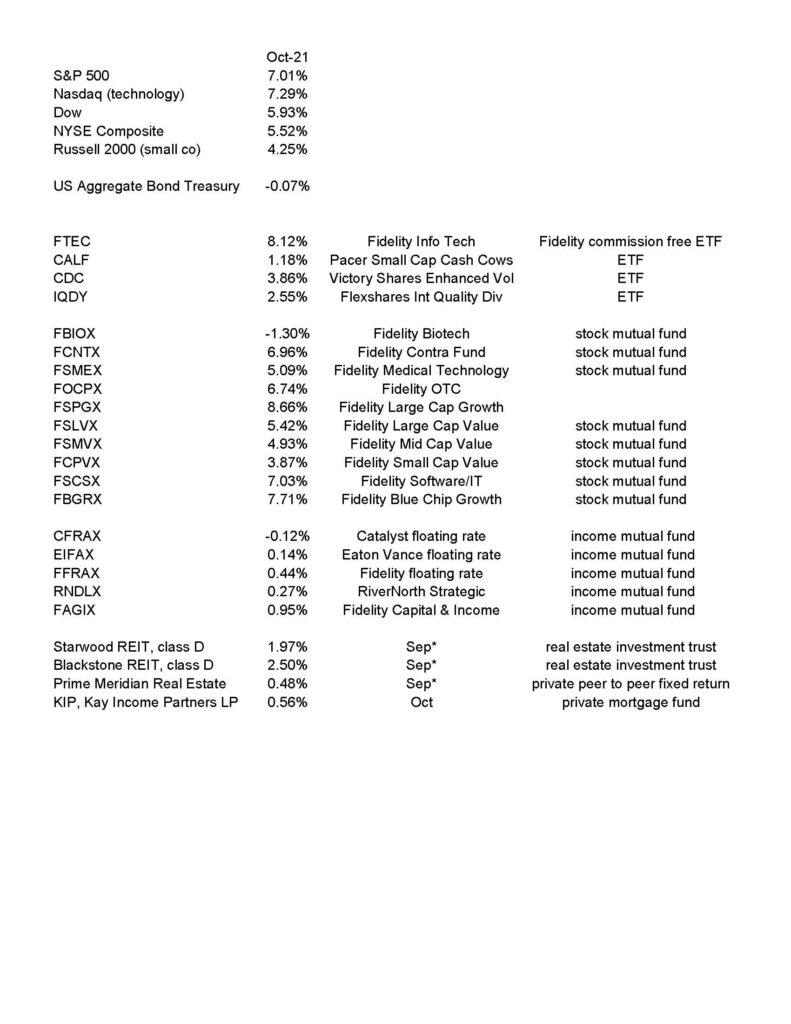

How Did the Markets and Our Funds Do in October 2021?

The below numbers are courtesy Morningstar Workstation: