“I don’t look to jump over seven-foot bars; I look around for one-foot bars that I can step over” … Warren Buffett

“Opportunity is missed by most people because it is dressed in overalls and looks like work.” … Thomas Edison

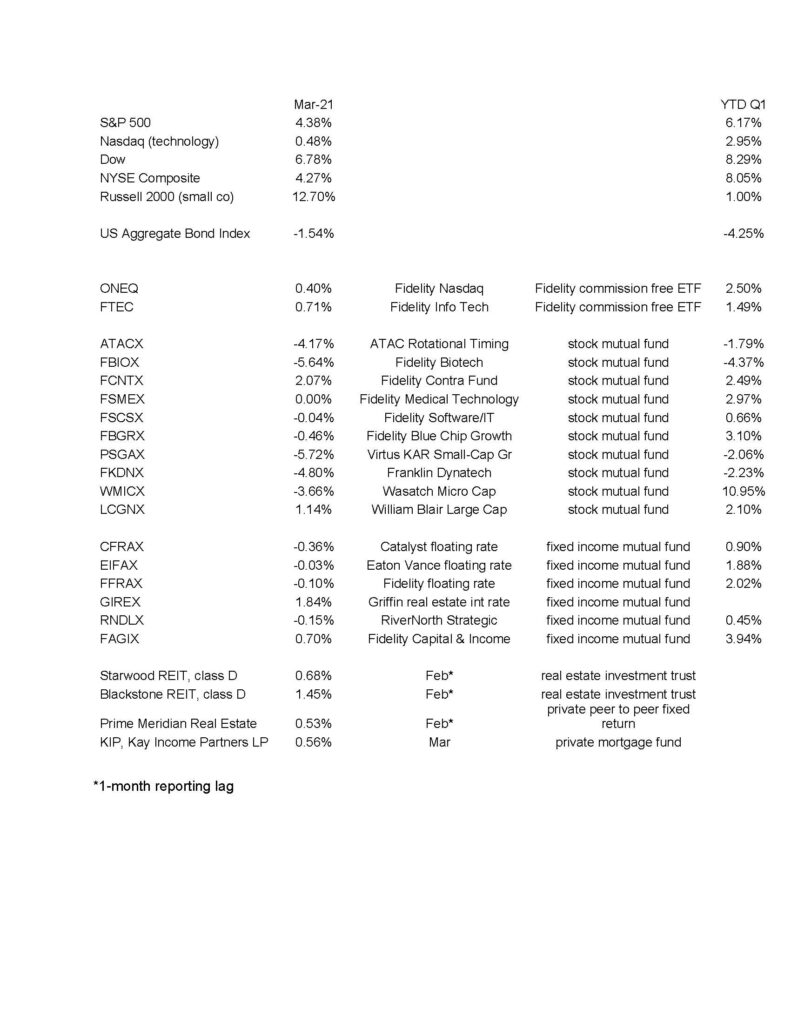

Where are we, at the end of March 2021 and YTD?

March was an up month for all the indexes, but our funds did not keep up, leading to small losses for many of the accounts. The culprits were several excellent funds that have made a lot of money for us but had losses in March. The ATAC rotation fund, which was up over 70% in 2020, lost 4.17%; the Wasatch Microcap, which was up 65% in 2020 (and up 11% YTD), lost 3.66%; and our tech funds had losses in March after out-performing for so very long – for example the Franklin DynaTech fund lost 4.8% after making 58% last year.

I do feel that certain changes are likely materializing in terms of market leadership. There is a movement towards value stocks – i.e. more established companies with solid earnings and possibly dividends. Our dividend paying stocks made over 4% in March.

I have taken action recently to reduce exposure to the ATAC fund and technology and to add value funds. We will be more diversified and stay abreast of the trends.

How Did the Markets and our Funds Do in March 2021 and YTD?

The below numbers are courtesy Morningstar Workstation: