“Investors must always distinguish between what they think the market should do and what the market is actually doing. If one were to base their investment decisions solely on [the financial news], their portfolio would still be in cash after missing the S&P 500’s 37% rally off the March 23 low”….. Lowry Market Trend Analysis

“I could end the deficit in five minutes. You just pass a law that says that any time there’s a deficit of more than three percent of GDP, all sitting members of Congress are ineligible for re-election. … now you’ve got the incentives in the right place, right?”…Warren Buffet, interview on CNBC

Where are we, at the end of May 2020?

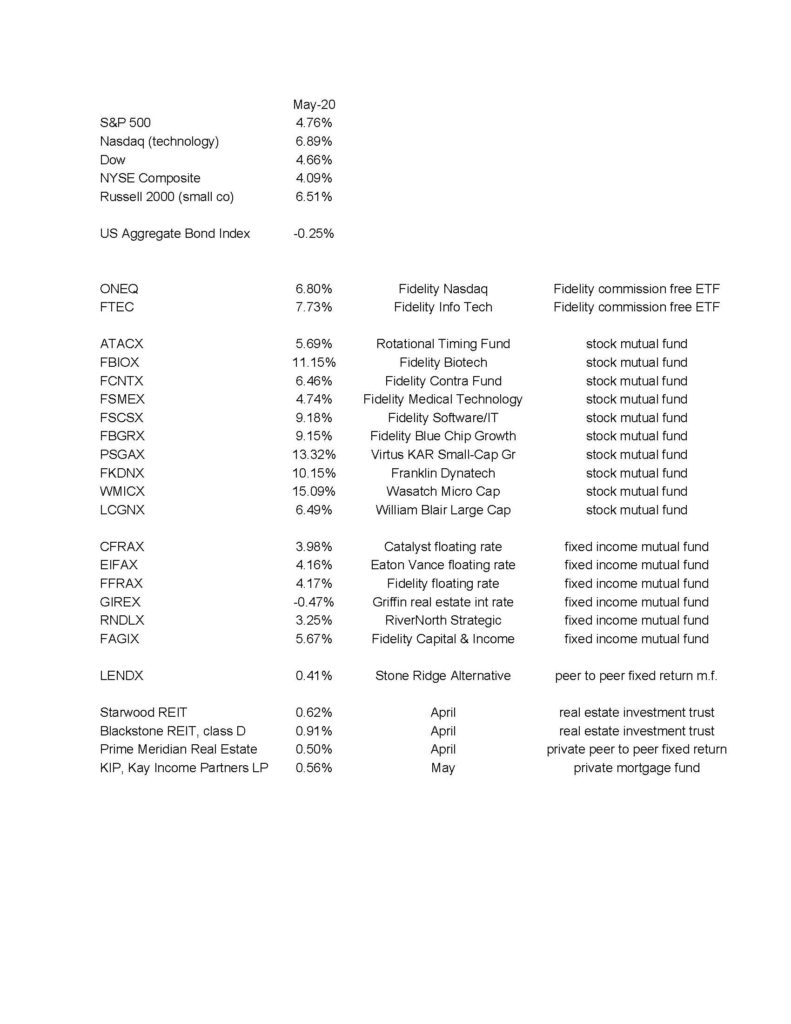

The stock market continued its powerful rally off the March 23 lows. Interestingly, every single mutual fund and every exchange traded fund that we are using outperformed the S&P 500 index in May. In fact, nearly all our funds outperformed nearly every index. Obviously, I’m pleased that we stayed in our investments. Had we jumped out of the market in early March, it would have taken a good while after March 23 to know when to reenter. The whole crash has been difficult to endure but we are well on our way back. Our technology funds are already up for the year. Our newer ATAC fund has had an amazing run all year. Finally, it is very encouraging that the small and microcap stocks/funds are now leading the way up. This is very healthy.

I don’t claim to know how durable this rally will be or whether future threats lurk, but I’m committed to keeping all of you investors in the best funds I can. I’ve added two more new funds: FSMEX and FSCSX (Fidelity medical equipment and Fidelity software and IT).

Our REIT investments seem to be back on track toward stable unit prices. Their dividend income remains steady.

How Did the Markets and our Funds Do in May 2020?

The below numbers are courtesy Morningstar Workstation: