“Look before, or you’ll find yourself behind.” — Benjamin Franklin

Where are we, at the end of May 2021?

While we bounced back in April, some of our funds lagged in May. The main culprit was our technology funds. We made so much in the way of excess gains over the last few years with technology, it required time to discern that the trend and the inertia were over. The principal cause, according to my understanding, was a tax proposal increasing corporate capital gains taxes – which would hurt technology stocks especially. Ironically, as of last week, I’m reading that this proposal might be rescinded. A general, longer term shift in market leadership from growth oriented companies to value oriented companies may also be underway.

In either case, I moved from technology into so-called “value” stocks and dividend payers. Value stocks are companies that emphasize high earnings and profits, as opposed to growth. It is like the real estate project that’s built for rental income, as opposed to just selling at a profit. The dividend payers are a great story – as I’ve touched on in recent newsletters. They average approximately 8% in dividends – which my research shows to be very steady and reliable. These are great investments even if you don’t need income, since the dividends can be compounded. The most gratifying thing about them, at this point, is that (aside from their income) they are appreciating more than any other type of holding or fund that I have. In addition, I’m buying at least 20 or more into the accounts, for diversification. The explanation seems to be that the investing public is judging high dividend income to be a good means of outpacing inflation.

Dividends are the new sweet spot.

If I’ve sent you an email regarding changing your Fidelity statements to email instead of paper, it is in order to receive commission waivers from Fidelity. If you have not addressed or responded to that email, PLEASE do.

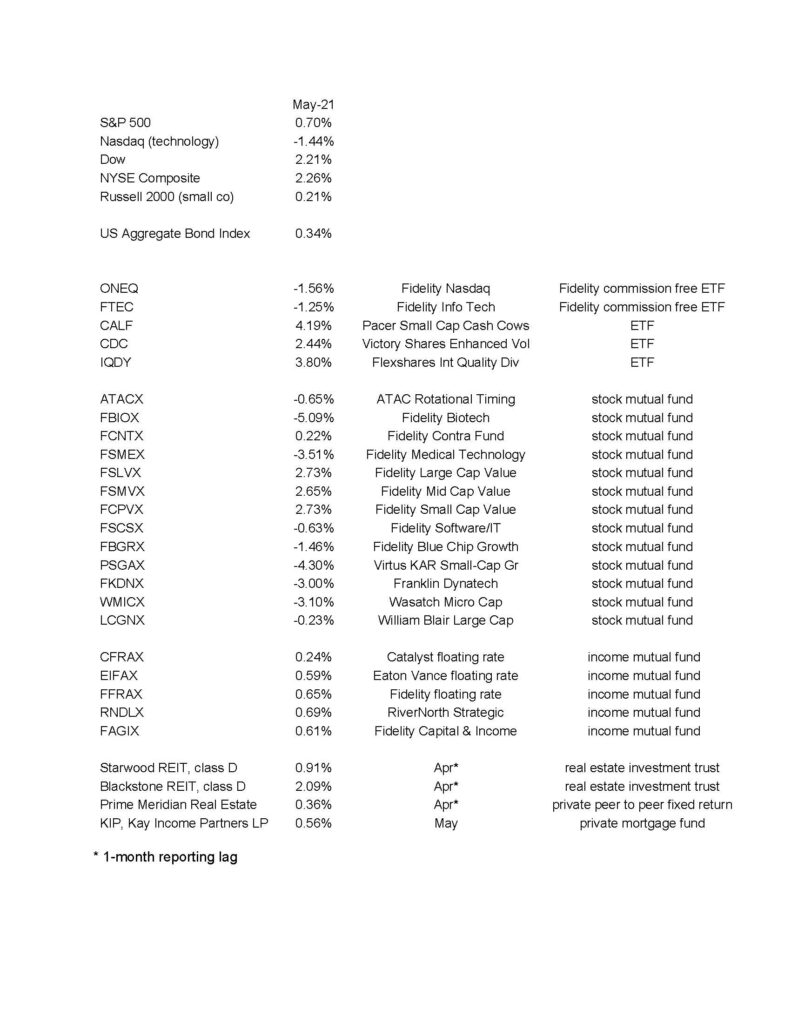

How Did the Markets and our Funds Do in May 2021?

The below numbers are courtesy Morningstar Workstation:

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.