“Nothing is as permanent as a temporary government program.” … Milton Friedman

“Many who are self-taught far excel the doctors, masters, and bachelors of the most renowned universities.” … Ludwig von Mises

Where are we, at the end of November 2020?

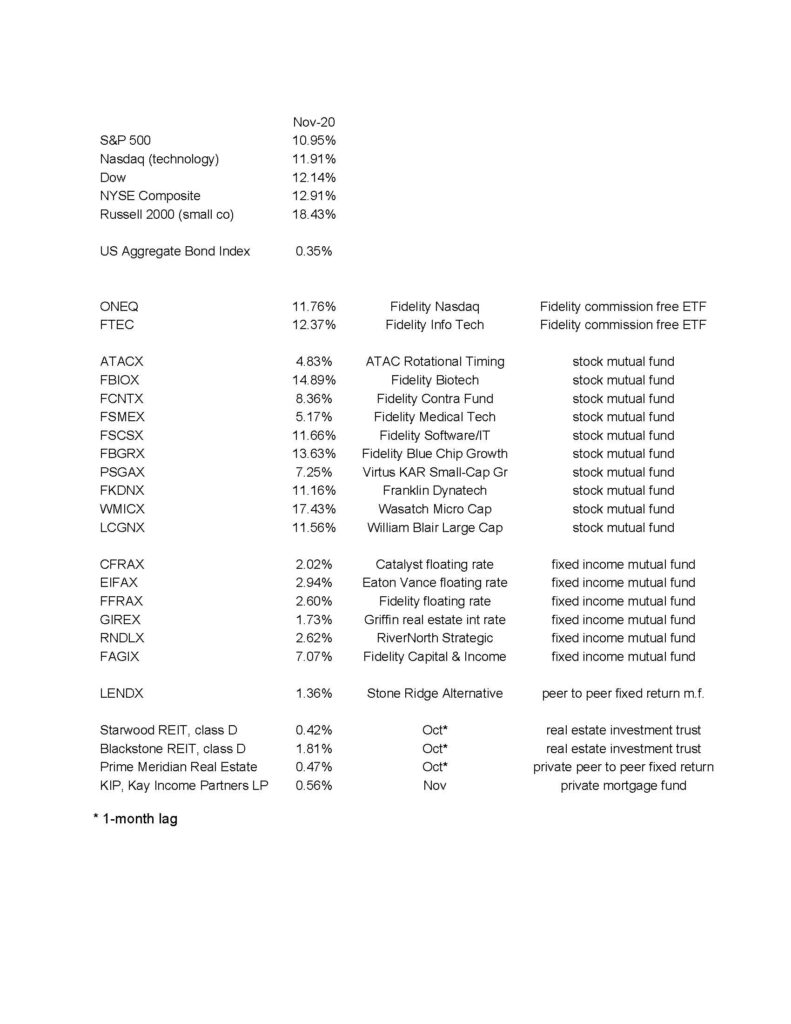

Looking back on the combined two months of September and October, the market indexes were down around 8% or so on average. In November, the indexes rose around 12%, more or less. So, we’ve ridden a roller coaster in order to be up maybe 1% per month (the S&P 500 rose 3.4% for the 3 month period). If only the markets could be steady!

The stock market is a very happy addict, hooked on government stimulus (printed money) and low interest rates. Of course, it also helps a lot that corporate earnings and unemployment have recovered well from the lockdown. For now, I believe the bull market is well intact and we are long stocks until further notice.

Our funds did well this month, but some did not do AS well, such as ATACX. This fund is up 55+% year to date but maybe it’s upsetting that it was only up 4.83% for November. I just don’t know…. I am still accumulating dividend producing funds and stocks creating reliable 8+% returns and figuring out how to make this efficiently available to all the clients who want it. Please contact me to discuss.

How Did the Markets and our Funds Do in November 2020?

The below numbers are courtesy Morningstar Workstation:

Your investment return(s) for November 2020 was/were as follows:

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.

Best,

Darrell J Kay

Kay Investments Inc