“The future ain’t what it used to be” …. Yogi Berra

“Unthinking respect for authority is the greatest enemy of truth” … Albert Einstein

Where are we, at the end of September 2020?

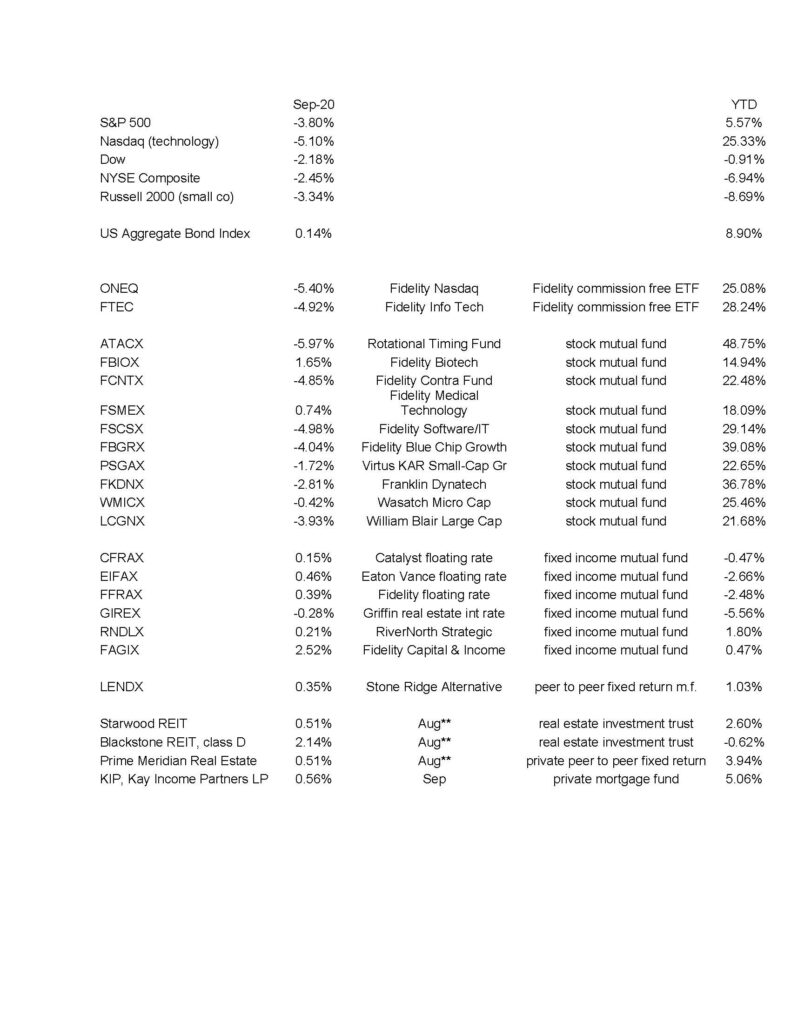

This month I am providing year to date (YTD) numbers as well as September month numbers. As I stated last month, it’s almost surreal the contrast in performance among the various market sectors. They do reflect differences in economic health. Leading the way is technology, up over 25% year to date. The S&P 500, which is dominated by Apple, Microsoft, Amazon, Facebook and Google, is up over 5%. The Dow Industrials, the NYSE Composite and the Russell 2000 (small companies) are all down. The Russell is down over 8%. Unfortunately, our fixed income funds have lagged seriously on a YTD basis. You may review the numbers below.

Clients have posed many similar questions to me this month and I will do my best to answer them from my perspective:

Are we about to face inflation? I believe so, although it may need a year or two to materialize. There is simply no way that the country can print trillions of dollars without having such an effect eventually. Otherwise, free money would have no consequence and we should print enough to make us all wealthy.

Is the stock market ready to tank in a serious way? The indications, as I see things, point to a continuation of the uptrend, subject to corrections.

Should I be concerned about the effect of the election? Understandably, markets dislike unforeseen change and uncertainty. However, things often don’t change as much as expected – no incoming (or returning) administration brings about all the change they campaign on.

What is the effect of “zero” interest rates? Nothing is free, and it creates distortions. The purpose of zero interest rates is to stimulate economic growth by encouraging companies (and people) to borrow and spend. However, this does lead to inflation and to imprudent borrowing. It also penalizes people who depend on safe, fixed income returns.

What can we do to prepare for what lies ahead? Unfortunately, when markets plunge, everything goes down – we saw that during the COVID decline and this has been a characteristic in recent years. There just aren’t uncorrelated sectors anymore. The only answer is to try to avoid the big bear market decline and try to align with funds that represent the strong sectors. You can see from the below performance numbers that we have been doing that.

Finally, as I touched on last month, I am building a portfolio of dividend paying stocks – yielding around 8% – with strong histories and reliable cash flow for the dividends. Aside from the benefit to people on fixed income, this can serve as another diversifier, which MAY help to defend portfolios against inflation.

How Did the Markets and our Funds Do in September 2020 and Year to Date?

The below numbers are courtesy Morningstar Workstation:

We should talk if you would like to review exactly where you stand or if we should consider a change. I am available at your convenience. I have Skype video in case you would like to do a video conference.

Best,

Darrell J Kay

Kay Investments Inc